- NZD/USD erased losses and bounced back to take out 21-EMA resistance at 0.6825.

- Kiwi was buoyed after RBNZ’s preferred measure of core inflation hit a 7-year high.

- Data released earlier today showed NZ Q2 CPI data that arrived at 0.4% and slightly lower than the 0.5% expected.

- But, later the RBNZ’s preferred measure of core inflation for the second quarter printed at a 7-year high of 1.7% year-on-year pushing the antipodean higher.

- The larger picture for the pair remains bearish. We see slight bullishness on intraday charts.

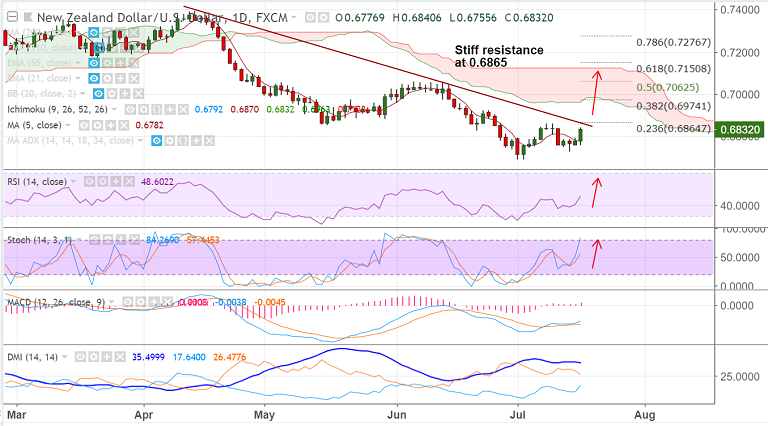

- Upside finds stiff esistance at 0.6865 which is converged trendline and 23.6% Fib. Break there could see further upside.

- The major could extend gains further if Fed’s Powell sounds dovish during his testimony to congress.

Support levels - 0.6825 (21-EMA), 0.68, 0.6782 (5-DMA)

Resistance levels - 0.6865 (converged trendline and 23.6% Fib), 0.69, 0.6921 (June 24, 25 high)

Recommendation: Watch out for break above 0.6825 for further upside, target 0.69/ 0.6920

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at 90.1932 (Bullish), while Hourly USD Spot Index was at -114.032 (Bearish) at 0900 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.