In bullish scenarios, we foresee NZDUSD to go towards 0.75 if:

1) The dairy sector’s recovery accelerates, reining in the current account deficit; or

2) The migration flows and housing kick up another gear.

In bearish scenarios, NZDUSD is expected to go below 0.68 if:

1) The housing market decelerates more sharply under the strain from tighter credit conditions;

2) Migration rolls over due to a shift in government policy;

3) The funding issues intensify, causing the market to question NZ's ability to attract capital inflow.

OTC Outlook and Options Trade Recommendations:

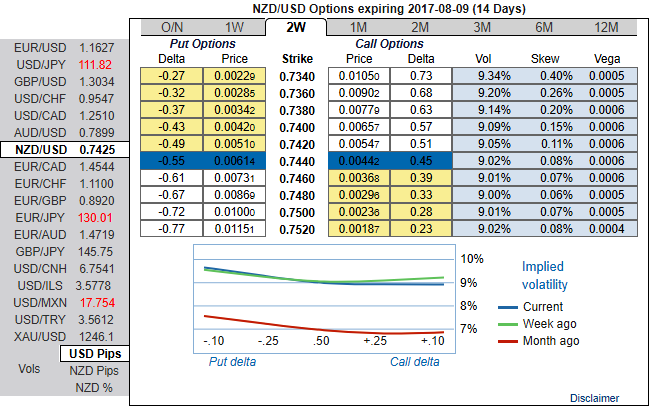

All the factors stated above seem to be discounted in FX options market, we’ve constantly been reiterating this strategy contemplating ongoing rallies. On 3rd July (at spot reference: 0.7275-0.73 levels) it was advised to deploy diagonal credit put spreads by writing 2w (1%) in the money put while initiating longs in 2m at the money put, the structure could be constructed at the net credit.

By now, you could easily make out short legs on ITM puts of 2w expiries are going worthless as anticipated.

Upon the mounting bearish risk sentiments are observed as you could see the positively skewed IVs in OTM put strikes of 1m tenors (refer positive IV skews indicate the strikes below 0.73 which is our forecasts).

The NZD volatility market normalized sharply (you could observe that in NZDUSD IV skews across all tenors) and IV skewness is quite favorable for OTM put option holders amid ongoing bullish swings, hence, we eye on writing overpriced in the money put options that are likely to reduce hedging costs of long legs.

Well, the positive skews in 2m implied volatilities signify hedging interests in downside risks further, while 2w skews have been well balanced suggesting robustness in ongoing rallies of underlying spot and the combination of IV 2w2m skews suggested credit put spreads that have favoured to arrest ongoing upswings in short run and major downtrend has to be taken care by 2m ATM longs.

Currency Strength Index: FxWirePro's hourly NZD spot index is at 9 levels (which seems neutral), while hourly USD spot index is edging shy above 50 (mildly bullish) at the time of articulating (at 08:18 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?