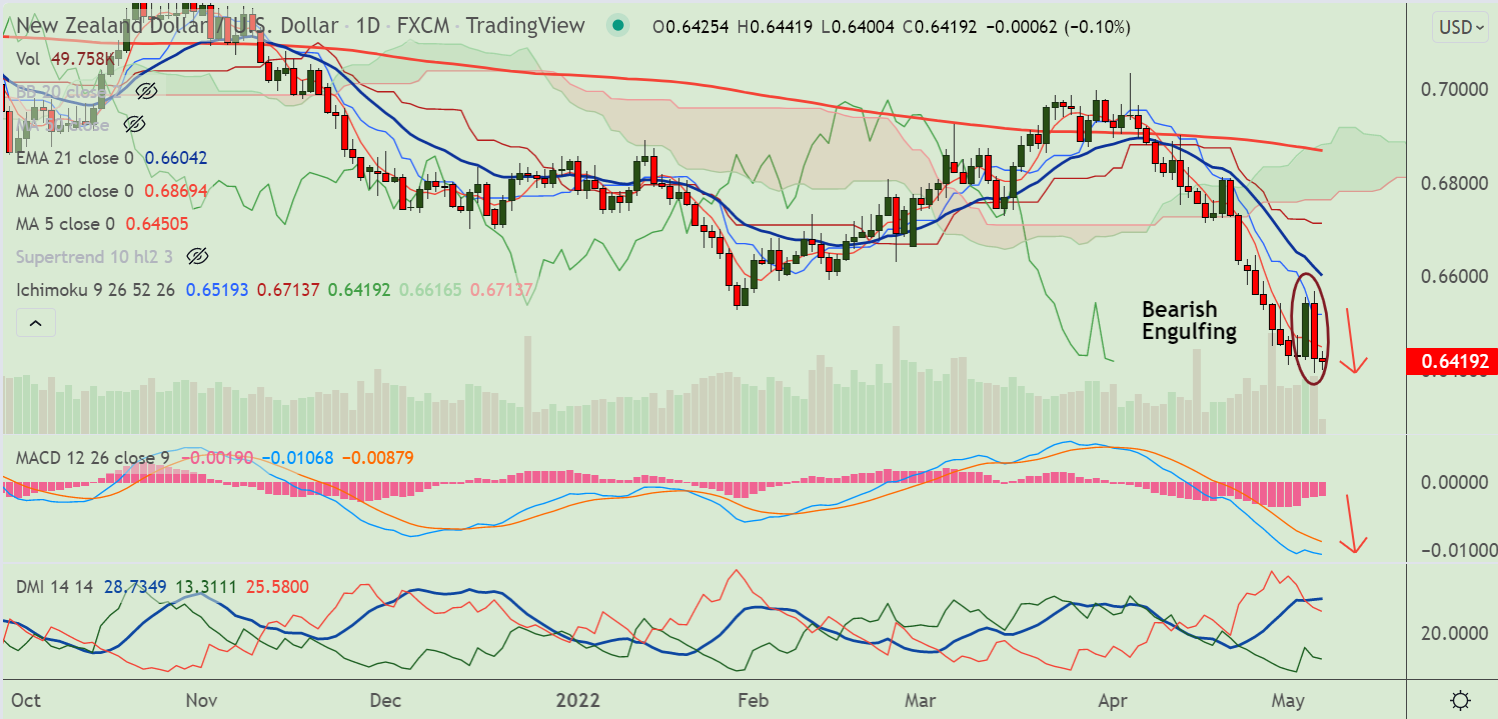

Chart - Courtesy Trading View

Spot Analysis:

NZD/USD was trading 0.08% lower on the day at 0.6420 at around 05:35 GMT

Previous Week's High/ Low: 0.6645/ 0.6451

Previous Session's High/ Low: 0.6568/ 0.6393

Fundamental Overview:

The pair remains rangebound ahead of US employment data.

A preliminary estimate for the US NFP is 391k against the past print of 431k.

Higher-than-expected job additions in the US labor force will strengthen the USD dollar and drag the pair lower.

Technical Analysis:

- NZD/USD has formed a 'Bearish Engulfing' pattern on the previous session's candle

- GMMA indicator shows major and minor trend are strongly bearish

- Volatility is high and rising and momentum is bearish

- MACD and ADX support downside, Chikou span is biased lower

Major Support and Resistance Levels:

Support - 0.6330 (Lower BB), Resistance - 0.6452 (5-DMA)

Summary: NZD/USD is set to resume downside. Watch out for US NFP data for further impetus.