Technically, the NZD/JPY bears establish robust volume build ups in the major trend, lingering supports 7DMA which seems to be broken to evidence more slumps, we devise a hedging strategy using FX options.

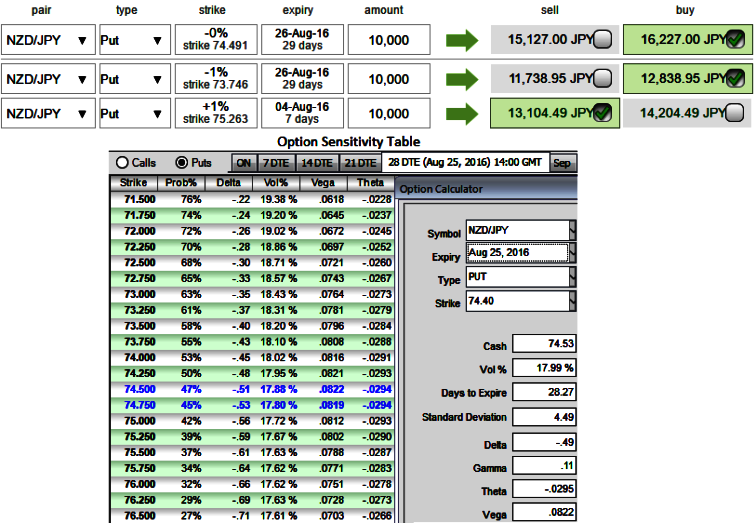

The execution of the strategy: Short 1W (1%) ITM put option and simultaneously add longs on 1M ATM -0.49 delta put option and one more 2M (1%) OTM -0.35 delta put option.

Rationale: Unlimited downside and limited upside profit potential and higher IVs favor option holders.

Ahead of BoJs and RBNZ’s monetary policy decision the ATM IVs of this pair are trending higher at around 53.61%, 17.99% and 24.47% for 1D, 1M and 1W expiries respectively which is the highest among G20 currency space that would divulge pair’s gain contemplating risk reversal arrangements, which means the market thinks the price has potential for large movement in either direction, but you can observe the %change in premiums as the put contracts drifts into in the money (there exists the crux of derivative contracts).

We reiterate the efficient usages of NZDJPY’s rising implied volatilities as stated in our previous post that could be used in option strategies as follows:

Load up longs in above-suggested option strategy by capturing the volatility risk premium in trading the gamma (dynamic delta-hedging).

Trading the volatility market (smile and term structure dynamics) non-directionally.

Trading implied volatility directionally along with trend (vega).

As the underlying spot keeps stagnant or rises a little, then the option premiums would shrink away due to the time decay because of theta effects, the sensitivity of an option’s value to the passage of time. So short leg would advantageous as this greek is usually expressed as the change in value per one day’s passage of time.

What does it do with current trend: Since the short put ladder is an unrestricted return with partial risk bearing strategy that is deployed because, in addition to the puzzling uptrend in the short term and downtrend in long-term, we think that the NZDJPY would also perceive significant volatility in the near term.

Please be noted the cost of trade has been reduced considerably due to narrowed tenors.

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty