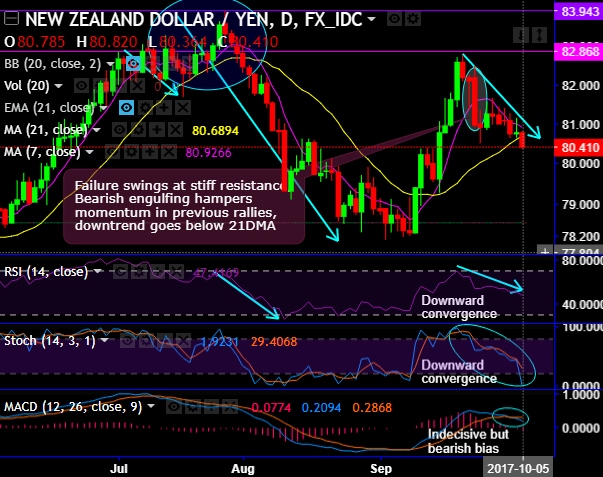

NZDJPY bears resume with hanging man and bearish engulfing patterns at 82.110 and 80.979 levels respectively, in minor trend and gravestone doji and shooting star at 80.985 and 82.811 levels respectively in the major trend.

The major resistance is seen at 82.868-786 areas that’s where, historically, the prices have rejected.

While in the short trend, the attempts of bull swings restrained below 7-DMAs, consequently, the current prices slid below 21DMAs.

RSI converges to the ongoing price dips as this leading oscillator trending below 50 levels which is the caution for aggressive bears.

Bearish momentum in short-term selling sentiments is intensified as stochastic oscillator converges constantly to the downside and evidences %D crossover which is again bearish signal.

NZDJPY price, volumes, leading and lagging indicators moving in tandem with bear swings.

MACD also substantiates this standpoint but this would be deemed as indecisiveness in current rallies.

Overall, the prevailing bearish sentiments are mounting to signal weaker trend below the 82.786-868 zone, which was signaled in the recent history as well.

Hence, we recommend shorting rallies on speculative grounds and decide to initiate buying one touch binary put options to participate in selling sentiment and append leverage to the yields.

Well, alternatively, at spot reference: 80.418, contemplating lingering bearish indications, we recommended a limited loss structure via double-no-touch optionality of far-month tenors, NZDJPY 3m DNT with 82.868 - 76.250 strikes – but we are reluctant to sell volatility outright given the unquantifiable risk. However, shorting volatility and fading the spike in skew through limited loss structures (i.e. DNT’s) could be appropriate.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -92 levels (which is bearish), while hourly JPY spot index was at shy above 157 (highly bearish) at the time of articulating (at 11:24 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: