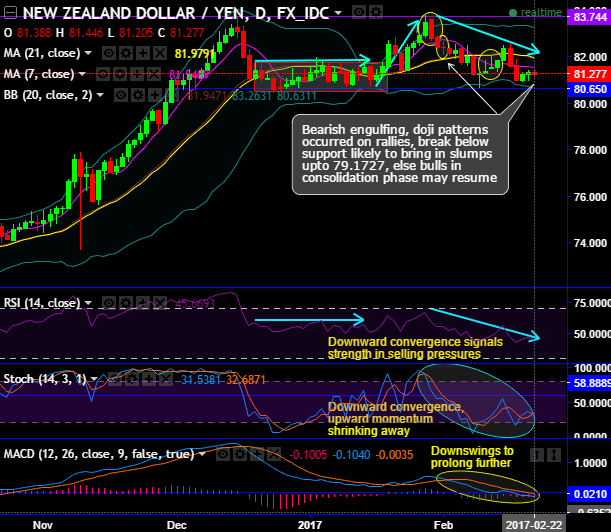

Bearish engulfing, doji patterns occurred on rallies, break below support likely to bring in slumps up to 79.1727, else bulls in consolidation phase may resume.

Well, after looking at the title of this write-up one might have been puzzled, a heavily bullish mindset isn’t that encouraging at this juncture as there are bearish indications are popping up in shorter timeframes.

After 8-9 months of consolidation phase in major bearish trend, a gravestone doji pattern occurred at the peaks of 81.019 levels (refer monthly chart).

This bearish pattern occurred at around 61.8% Fibonacci retracements, from last three months you could observe the struggle at the same juncture. Historically, the same pressure sensed at this levels.

From last week, the price upswing was able to come out of the tight range that persisted since 20th December, any attempts of upswings further restrained below a stiff resistance of 81.9794 levels (21DMA), break above these levels likely to drag more rallies, else bears have equal opportunities on the contrary.

RSI converges to the uptrend on monthly terms as this leading oscillator signaling the losing strength near 70 levels which is overbought territory, while on daily charts downward convergence indicates gaining momentum in price dipping.

Buying momentum on both short and long-term rallies are not convincing by the stochastic oscillator as there is an attempt of %d crossover above 80 levels which is again overbought zone, but this indication is in favor of the consolidation phase. MACD here signals bearish swings in short run and bull swings in consolidation phase to prolong ahead.

The upswings have gone above EMAs, now on the verge of bullish EMA crossover (see monthly chart), price slumps have gone below DMAs (see daily chart).

Hence, we recommend using these rallies for trading via leveraged instruments.

Trading tips:

For intraday trading perspective, it is advisable to buy boundary binaries on dips upper strikes at 81.9809 and lower strikes at 80.650 within the binary expiry duration.

On the flip side, stay long in mid-month futures on hedging grounds to mitigate the upside risks of this underlying spot fx in the weeks to come.