The current prices of this pair are sensing pressure at stiff resistances of 0.96-97 levels on various fundaments factors, we reckon ongoing upswings could be optimally utilized in order for reducing hedging cost.

Crude oil prices were up by almost 2% on Monday (we’ve seen a sharp gap up opening today) on renewed optimism that OPEC would agree to cut output.

OPEC members are currently negotiating to deliver a planned cut in output to 32.5-33 million barrels a day, so, we could more prospects for crude prices which in turn could act as a positive driving force for oil driven currencies like CAD. Additionally, analysts ponder over RBNZ’s OCR cuts are unjustifiable as Kiwis have been producing steady growth.

Thus, we think NZD momentary gains again CAD seems to be momentary, bulls unlikely to gain traction against CAD

Despite today’s rallies, wee NZD likely to struggle for momentum as stated in our recent technical write up, the bearish DMA crossover to evidence more slumps as the current prices consistently remain below DMAs. The break below supports of 0.9517 signals bearish pressures, snap rallies to deploy fresh shorts.

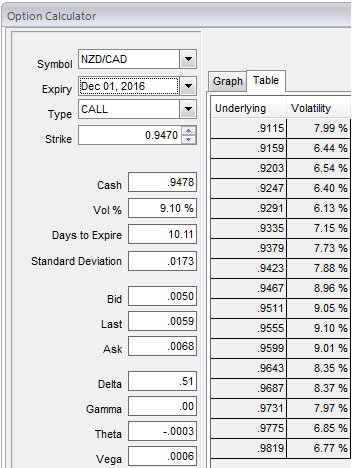

As you can see NZD/CAD 10D ATM IVs are at 9.19% which are unjustifiable as there are no fundaments factor that could drive this pair to any dramatic fluctuations except crude’s price gains. But apart from this, on the data front, we don’t see any significant data events in this span.

Hence, on the hedging grounds, one can prefer below option spread with a view to establish a strategy to arrest downside risks with reduced hedging cost.

To factor in the weakness in this pair as we could see reasonable IVs even in next 1-3m expiries, we recommend capitalizing more on bearish signals and the IV factor in the long term by employing OTM longs matching with ATM longs to construct back spreads that likely to fetch positive cash flows.

So, here goes the strategy this way, Go long in 2 lots 1M ATM -0.50 delta puts, long in 2M (1%) OTM -0.35 delta put, and simultaneously short 2W (1%) ITM shorts, the spread is to be executed in the ratio of 2:1 with net delta at around -0.70.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data