As we have the flurry of data releases in Canada, we foresee option trading opportunity in NZDCAD.

Canadian trade balance is scheduled to be released today, and it is forecasted to print -2.6B versus previous -2.9B.

Building permits and PMIs have been scheduled for tomorrow, while unemployment claim is lined up on Friday.

BoC’s monetary policy and manufacturing sales are key focuses for next week.

On account of these entire data events put together, we could foresee higher implied volatilities in the days to come.

FX Option Trading Strategy:

Strategy: 3-Way Diagonal Straddle versus OTM Call

Spread ratio: (Long 1: Long 1: Short 1)

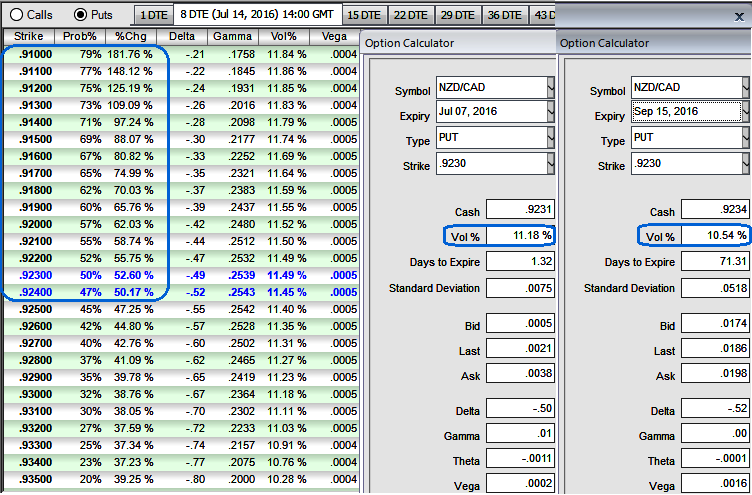

Rationale: Let’s glance on sensitivity tool for put options of this pair, it flashes up higher probabilistic numbers for OTM strikes which would mean that higher likelihood of expiring these contracts in-the-money.

As we have ATM implied volatility of these contracts of 1w tenors are on higher side, thereafter in a long run IVs are stagnantly creeping up above 10.50%, synthesizing all these aspects in a go, the higher IV implies the market reckons the price would more likely move towards these put option strikes, as a result we reckon it is beneficial for OTM call strikes writers.

At current spot at 0.9235, the pair is likely to move towards lower strikes in volatile markets caused by data season as stated above, we would like to position the option trades as shown below so as to match the sensitivity tool indications.

The execution:

Go long in NZDCAD 1M at the money -0.49 delta put, and go long 1M at the money +0.51 delta call and simultaneously, Short 1W (1%) out of the money call with positive theta.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms