- NEO/USD weakness short lived, downside in the pair rejected at session lows at 105.75.

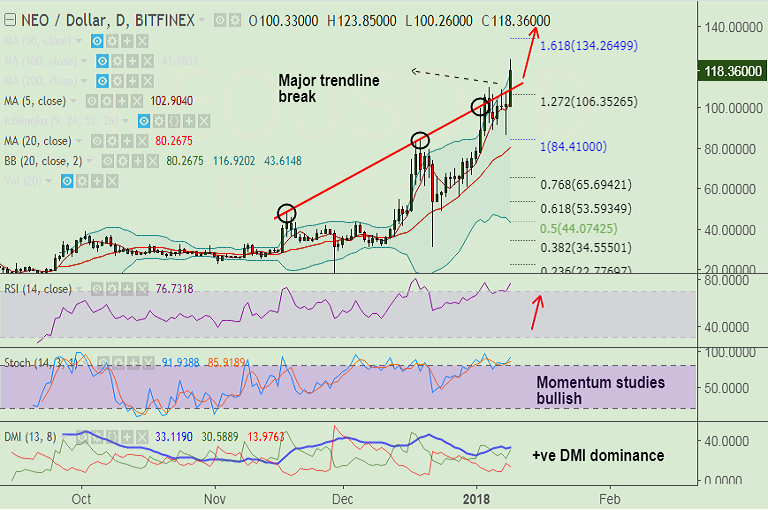

- The pair has shown a decisive break above major trendline resistance at 109.50.

- We see upside intact as long as the pair holds above 5-DMA support. Close below could see some weakness upto 20-DMA at 82.98.

- Technical studies support further upside, we do not see signs of reversal in the pair.

- RSI is strong above 70 levels, 5-DMA sharply higher, 20-DMA supports uptrend.

- Momentum studies are bullish, Stochs are biased higher. We see +ve DMI dominance.

Support levels - 109.22 (5-DMA), 106.35 (127.2% Fib extension of 3.7385 to 84.41 rally), 82.98 (20-DMA)

Resistance levels - 131.42 (Jan 9th high), 134.26 (161.8% Fib), 214.93 (261.8% Fib)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-NEO-USD-breaks-major-trendline-resistance-at-10950-scope-for-test-of-1618-Fib-at-134-1087646) is progresssing well.

Recommendation: Bias higher, stay long.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary