In global FX market, everywhere you see the only trendy voice that you could hear is that the US dollar weaker, weaker, weaker. USD only moves in one direction at the moment that is southwards. Be it against EUR, JPY or CNY: USD is easing on a broad basis. Against EUR it is slowly approaching the 1.20 mark. It is becoming gradually clear that the greenback is also suffering not only as a result of Fed’s recent guidance but also the President Trump’s weak government. It is unfair to give all credits on Fed’s kitty. Central banks’ policy divergence is the other predominant aspect to be considered.

The broad dollar ground lower in the recent times to make a fresh multi-month low even though the Fed indicated that balance sheet normalization is on the cards for September. The red flags for the currency came in on the back of a tweak in the Fed’s language on inflation was interpreted by markets as dovish and activity data beat expectations in Europe and Asia.

The US data released at the end of the week further reinforced bearish momentum for the dollar with the important quarterly employment cost index coming in below than expectations, thus indicating soft inflation pressures in the US.

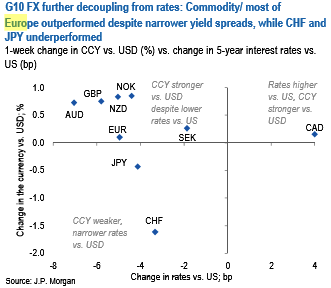

The macro theme of Europe leading outperformance remained dominant with Scandis outperforming in G10 on strong data/higher oil prices and EMEA in EM. Other remarkable market moves came from:

i) Swiss franc (EURCHF made a new high since the SNB abandoned the floor) on possible M&A flow and SNB comments that while not a departure from their previous stance, reiterated that their policy stance remains unchanged putting them in contrast with several other DM central banks where policy is evolving, and

ii) The commodity prices with oil and base metals higher across the board, giving commodity currencies a lift as well, despite narrower yield spreads (refer above chart). Against this backdrop, the portfolio has fared well in the past week.

In G10, longs in Europe (EUR, NOK) vs USD and JPY have broadly paid off while the performance of EM trades has been more mixed.

Recent FX market moves in G10 have been primarily about a divergence in central bank policy, so a strengthening in currencies where central bank policy is likely to or has already started to pivot (ECB, BoC) vs. those where central banks are likely to keep policy unchanged and stay dovish (BoJ and possibly SNB).BoC) vs those where central banks are likely to keep policy unchanged and stay dovish (BoJ and possibly SNB).

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed