On the eve of the monetary policy season for the week, responding to a deteriorating global economic outlook and rising event risks (largely from US trade policy), the key Fed/ECB/BOJ/RBA officials have lately spoken of their readiness and the room to step up on monetary accommodation.

BoE is lined up for their monetary policy amid ongoing political uncertainty indicates a continuation of the ‘wait-and-see’ message regarding the timing of the next bank rate hike.

The urgency to hike anytime soon, however, is likely to be little changed, particularly with the outlook still clouded by the Brexit fog.

However, the quieter sentiment on the markets has got one major advantage. For all those who may not have hedged their GBP risks yet, the current situation provides a reasonably attractive entry level.

The bank rate was left at 0.75% in the previous meeting. The last time the rate was changed was back in August 2018, when it was raised by 25bps. The decision today by the MPC to leave interest rates unchanged was unanimous. In terms of market expectations, futures contracts indicate that the market is not anticipating any rate hike this year. Contracts suggest that the market is not envisaging a rate increase until the end of 2020, taking rates up to 1% and remaining at this level by the end of the BoE’s three-year forecast horizon in 2021. Overall, the BoE retains a tightening bias, evident in its assessment that the economy will likely require rate hikes over the next three years. Given on-going Brexit uncertainty, a rate hike seems unlikely this year.

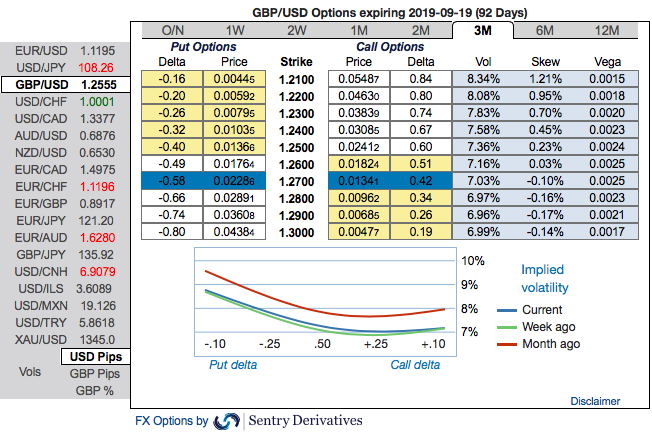

OTC outlook: Addition of negative bids has been observed in the GBPUSD risk reversals for shorter tenors. While positively skewed implied volatilities of 3m tenors have still stretched towards OTM put strikes up to 1.21 levels. To substantiate this downside risk sentiment, risk reversals have also been signaling bearish hedging sentiments.

We reckon that the sterling should not suffer like before, but, one should not disregard the Brexit settlement risks on the other hand. The market has always ignored the fact that all the current BoE interest rate moves are due to a favorable result of the Brexit process.

Both the speculators and hedgers of GBPUSD are advised to capitalize on the prevailing price rallies for bearish risks and bidding theta shorts in short run (1m IVs) and 3m risks reversals to optimally utilize delta longs.

Strategic Options Recommendations: On hedging grounds, fresh delta longs for long-term hedging comprising of ATM instruments and OTM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way: Short 1m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, initiate longs in 3m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium.

Thereby, the above positions address both upswings that are prevailing in the short run and bearish risks in the long run by delta longs. Courtesy: Sentrix & Saxo

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -173 levels (which is highly bearish), and hourly USD spot index has bearish index is creeping at -27 (mildly bearish) while articulating (at 07:18 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?