As regards the Bank of Mexico’s (Banxico) rate decision today analysts expect a further rate hike by at least 25bp. As this is largely priced in on the market the peso is unlikely to appreciate notably in the case of a 25bp rate hike. The central bank is under pressure to take action as inflation has risen notably over the past few months.

The central bank of Mexico raised its benchmark interest rate by 50 bps to 6.25 pct on February 9th, 2017, in line with market expectations. It was the fourth straight hike, bringing borrowing cost to the highest since April of 2009. The decision aims to protect the currency and to prevent additional inflationary pressures after the government increased gasoline prices.

Both the overall and the core rate had recently exceeded the central bank’s target rate of 3%. Important drivers are the depreciation of the peso until the end of January as a result of the US elections and also the Mexican government’s energy reform at the start of the year that led to a strong rise in petrol prices. At the same time, the peso is also an argument in favor of a small rate step.

The peso has regained most of the ground lost as a result of the Trump effect since the end of January. Against a currently peso friendly background 25bp should be sufficient today. The fact that some analysts are expecting a larger step is unlikely to lead to significant MXN losses.

Hedging Strategy:

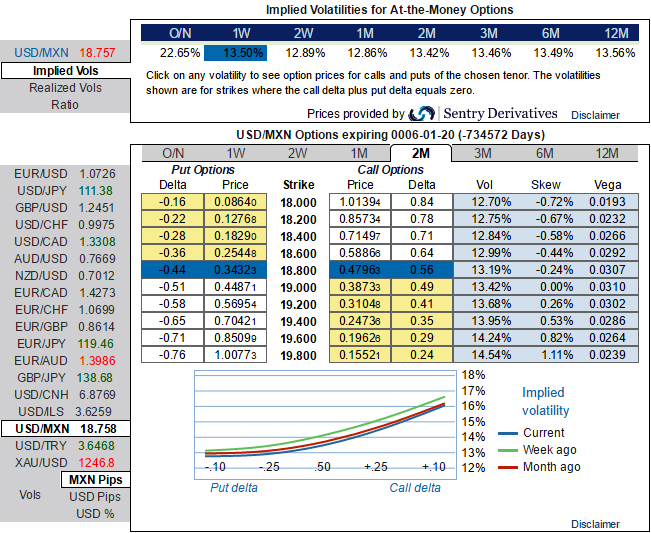

After weekend’s correction in USDMXN from the highs of 18.75 levels, the pair is rejecting below resistance at 7DMA in the major uptrend and likely to show strength only at next strong support at 18.2890 (i.e.21EMA) to resume its previous bullish rallies, for now, the major uptrend appears to be robust and likely to prolong further. Hence, we use dips effectively to deploy shorts in OTM calls.

While ATM IVs of this pair is substantially spiking higher above 13.5% and 13.42% for 1w and 2m tenors and positively skewed IVs are signifying the hedgers’ interests in downside risks which is conducive for the holders of the call options, using the prevailing dips in this underlying pair writing narrowed tenor OTM calls would reduce the cost of hedging.

Thus, using any abrupt dips, initiate a diagonal debit/bull call spread (DDCS) at net debit.

The execution: Initiate shorts in 1W (1%) out the money calls with positive theta, simultaneously, buy 2M (1%) in the money 0.51 delta call option. Establish this option strategy if USDMXN spot FX is either foreseen to be in sideways or spike up considerably over the next month but certainly not beyond your upper strikes in short run.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons