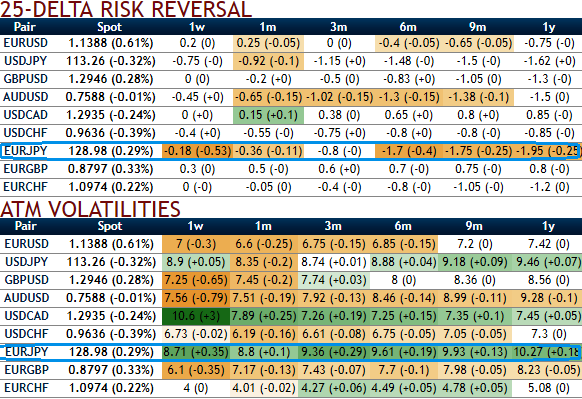

Please be noted that the IVs of EURJPY is spiking highest among G10 FX space and risk reversals have been indicating bearish risks in short run and has been neutral in the long run. A Risk Reversal is an individually tailored hedging solution, structured to meet your needs.

Technically, this pair has broken a stiff resistance of 128.875 levels, current prices spike well above SMAs. On a broader perspective, bull swings seem to be gaining traction above 50% Fibonacci levels, as a result, rallies are heading towards one and a half month highs in the consolidation phase with bullish EMA crossover.

We think the pairs such as EURJPY are blowing IVs on higher levels in G10 OTC FX space that pops up with rising IVs above 8.5% for 1-month and 9.36% for 1m and 3m tenors respectively (highest among the space) having significance in economic drivers that propels this currency pair to anywhere.

We think the same HY IVs with longer tenors are conducive and justifiable for option holders as there are series of considerable economic events lined up going forward.

Well, in order to arrest this upside risk that is lingering in intermediate trend and prevailing uptrend, we recommend diagonal option strip that favors underlying spot’s upside bias in short run and mitigates bearish risks in long term.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 2 lots of 3M ATM -0.49 delta puts and 1 lot of ATM 0.51 delta calls of 1m expiries.

Since the spikes are likely in near term and downswings in longer term seem to be dubious as per the signals generated by risk reversals as well as from IV skews, EURJPY option straps strategy should take care of both upswings and downswings simultaneously, even if the BoJ surprises with the forecasters, and the strategy is likely to derive handsome returns on the downside and certain yields regardless of swings on either side but with more potential on downside.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms