Markets remain in their current ranges as we await the FOMC and ECB meetings, the UK election and news of whether we will get a ‘phase 1’ trade deal. Data would have to be significantly away from consensus to drive the market away from the current pricing of central bank expectations and override events.

According to a highly anticipated YouGov survey, which is taking into account smaller parties, the Tories' lead is more narrow than thought so far. YouGov have said they will publish an update of their MRP (‘multilevel regression and post-stratification’) poll at 10pm tonight (its previous poll on 27 November was closely watched and predicted a 68-seat Conservative majority).

While the Labour Party is still lagging well behind the Conservative Party under Boris Johnson, the poll results suggest that the Tories might only win a slim majority. If they should even miss a majority in the end, this would be a particularly hard blow for sterling bulls.

Because not only would the pound then need to give up all its gains of the past weeks, but also the Brexit suffering of recent years would continue indefinitely, that is: There would still be no majority for a Brexit solution in Parliament, which would either lead to a "rolling EU membership" and continuing Brexit uncertainty, or in a "political accident" at some point and a hard Brexit. Certainly, all hope is not yet lost. Nevertheless, the rise in short-dated EURGBP risk reversals number seems well justified against this background.

Just before the UK’s parliamentary elections and ECB monetary policy, both scheduled for tomorrow, it's getting interesting after all.

This double-header of favourable political developments (the UK election sentiments in addition to a Brexit deal) in the near future could herald a tactical turn for the better in the general risk climate.

Hence, our defensive stance in EURGBP has been dictated by the receding global economic tide, but we cannot ignore that political risk has been an instrumental factor in these worse macro outturns. This warrants a tactical reduction in our defensive exposure but we uphold our hedging portfolios via 3-way straddles.

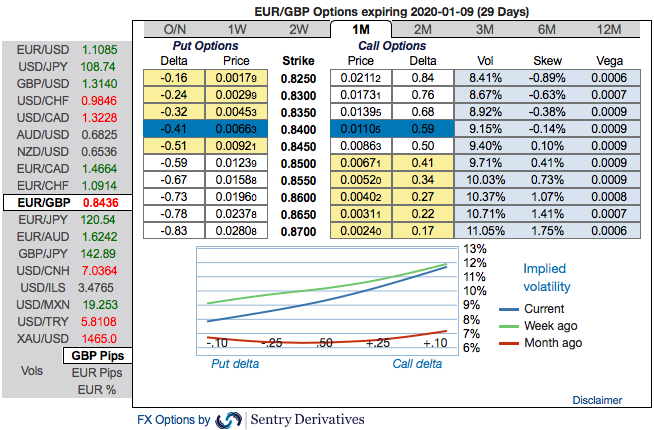

The passively skewed IVs of 1m tenors are stretched are indicating upside risks, more bids are observed for OTM call strikes up to 0.87 level for 1m skews and 0.90 for 6m skews.

While EURGBP risk reversals of the existing bullish setup remain intact with fresh bids for bullish risks. Below options strategy could be deployed amid the expected turbulent conditions. According to the OTC FX surface, 3-way options straddle versus ITM puts seem to be the most suitable strategy for EURGBP contemplating some OTC sentiments and geopolitical aspects.

Options Strategy: The strategy comprises of at the money +0.51 delta call and at the money -0.49 delta put options of 2m tenors, simultaneously, short (1%) ITM put of 2w tenors. The strategy could be executed at net debit but with a reduced trading cost.

Hence, on hedging as well as trading grounds, initiate above positions with a view of arresting potential FX risks on either side but slightly favoring short-term bearish risks. Courtesy: Sentrix, Saxo & Commerzbank

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential