After previous monetary policies from ECB, Fed and BoE, the euro and sterling OTC market turbulence was cooling off, as the hedging sentiments for certain currency pairs have been losing the traction.

The focus this week turns to the ECB and the Fed. The ECB will not take any fresh action but the press conference will be interesting for views on its reaction function as inflation forecasts start rising.

The ECB may also consider reinstating the collateral waiver on Greece. In the US, we expect a weak non-farm payrolls number for May which would increase the hurdle for the Fed to hike in June.

Ahead of UK's PMIs in this week, sterling gained against the majors except Euro, GBPUSD was up almost 0.13% at 1.4607 from the lows of 1.4587 earlier European session.

In this month, GBPUSD with BoE's unchanged bank rates at 0.5% were already factored in as it was much anticipated move that kept sterling away from much of hedging activities.

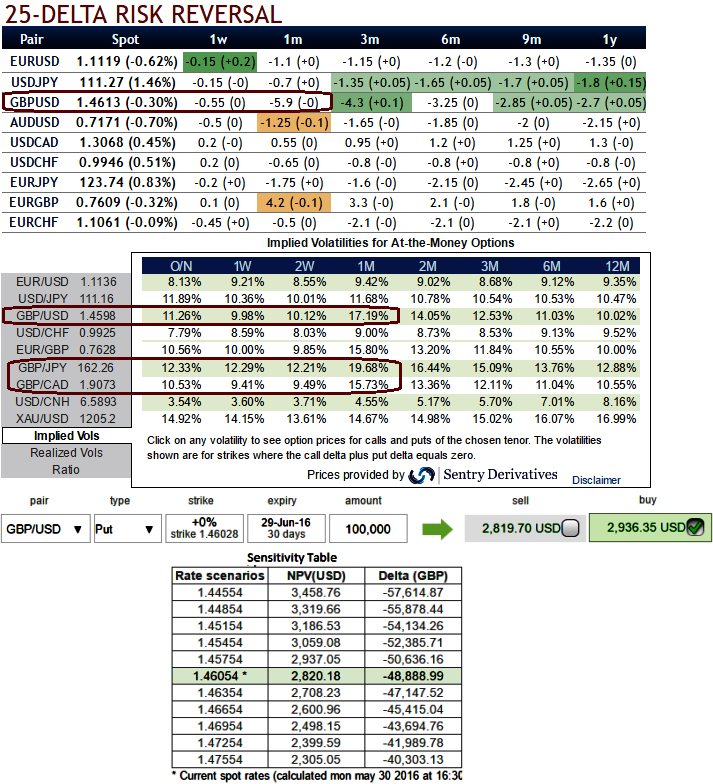

But for now, the implied volatilities flashed screaming off as the sterling crosses surged because UK PMIs are likely to indicate prospects of their economic health - businesses react quickly to market conditions and Fed is on the focus during mid June. UK referendum is on the other corner that appends sizeable risks to sterling.

1m IVs of GBP crosses are observed to have spiked massively considering above event risks, highest among G10 currency space.

While, risk reversal numbers are also flashing highest values that indicates the hedging instruments getting expensive in OTC markets anticipating downside risks.

We stated in our previous write up as well that the vols in OTC are likely to pick up rapidly again in 1-3M tenors as these tenors encompasses all significant data events.

The above table ranks in rising implied volatility among G10 currency crosses, sterling overreacting due to upcoming economic events but likely to tumble and stabilize at 12.5% in coming months. IV and risk reversal readings of GBPUSD have been the best buys on for selecting put options.

Hedging bets:

Let's now consider ATM GBPUSD put options of 1m tenors, they are trading at just shy above 4.11%.

While delta risk reversals are still flashing up progressively with positive numbers that favours bulls and indicates they are willing to pay OTM strikes in higher vols.

Since, IVs of ATM contracts are at higher levels with negative risk reversals would mean that puts have been underpriced relatively to the calls.

During Brexit scenario, at spot FX of GBPUSD is trading at 1.4603, and is anticipated to tumble moderately in the months to come, so it is better to use near month at the money puts with 50% delta in any hedging strategies.

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025