A gradual reduction of shorts (be it profit-taking purposes, or declining risk-reward) is likely to accelerate the move lower in USDMXN. Weakened fundamentals (economic slowdown, widening capital account deficit) might have played a part in MXN's underperformance, given Mexico’s tight linkages with the US cycle.

However, going forward, we expect these factors to remain secondary in consideration and solid fundamentals in Mexico, based on the diminishing significance of idiosyncratic risks elsewhere in EM. Mexico still has a reasonable economic performance, with GDP growth expected to reach 2.4% this year (IMF) and OECD leading indicator boding for an impending improvement in GDP dynamics.

The MXN remains cheap given the current oil price, providing an attractive entry point. This is particularly true against other trade-sensitive currencies and even more so if oil prices are either range-bound or set to crawl higher over time. Indeed, as highlighted by our model (click here for more), given the current levels of oil and the DXY, the MXN remains undervalued on a historical basis, showing a divergence of 1.5 standard deviations relative to fair value.

We maintain our constructive stance on oil for the next year, and our oil analyst forecasts Brent at $48/bbl for Q3’16 and $50/bbl for Q4’16. The rebalancing process between supply and demand is ongoing, and we expect a broadly balanced market by the next four quarters, with significant stock draws in H2’17.

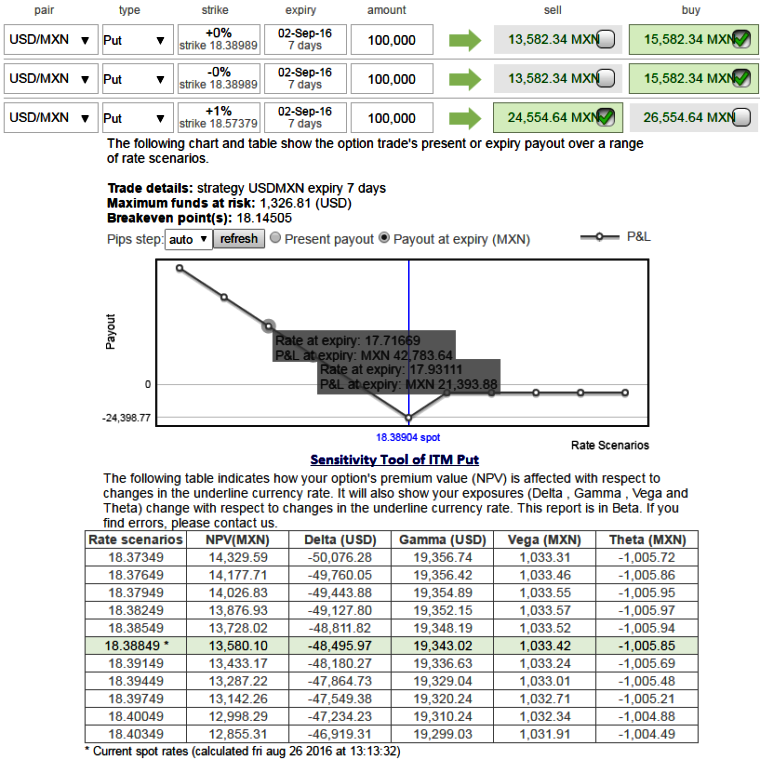

As we expect the underlying currency exchange rate of USDMXN to make a larger move on the downside. It is wise to capitalize on prevailing rallies and sell 1W one lot of (1%) In-The-Money put option, simultaneously buying 1M 2 lots of At-The-Money -0.51 delta puts. Please be noted that the tenors shown in the diagram just for demonstration purpose only, use accurate tenors as stated above.