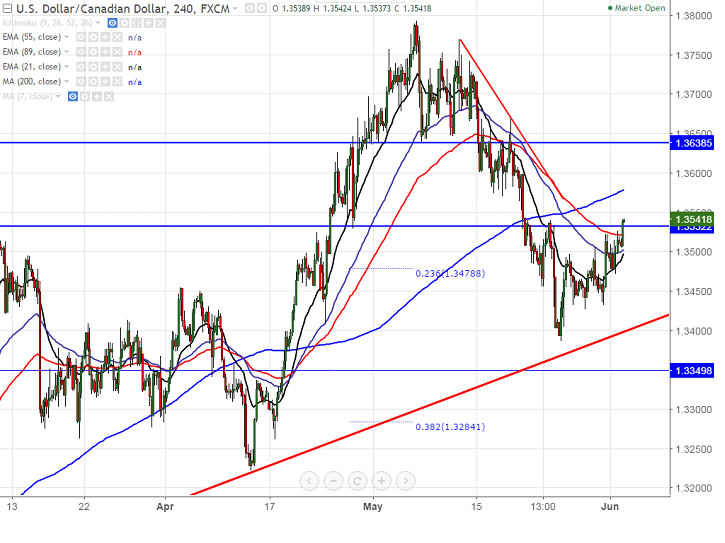

- USD/CAD consolidation still in progress and outlook remains unchanged. Intraday trend is still neutral and minor bullishness can be seen only above 1.3576 (200- 4H MA).The pair made a low of 1.33876 and shown a jump on account of declining crude oil. It is currently trading around 1.3450.

- WTI Crude oil broken major support $48 and declined till $47.24. Break below confirms minor weakness, a decline till $45 is possible.

- USD/CAD major short term resistance is around 1.3575 (200 4H MA) and any break above confirms minor bullishness, a jump till 1.3595/1.3640 likely.

- On the lower side, loonie major support is around 1.3380 and any break below confirms that jump from 1.2964 comes to an end at 1.37935 and dip till 1.3285 (200- day MA)/1.3220 likely.

It is good to sell on rallies around 1.3560 with SL around 1.3600 for the TP of 1.3410/1.3290.