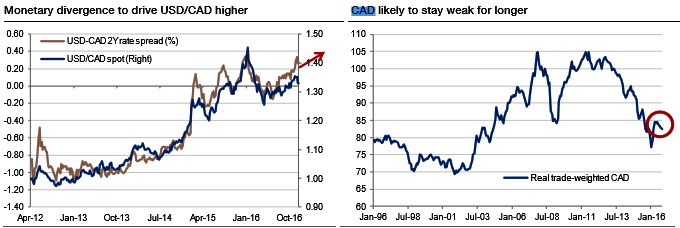

The Canadian dollar now appears cheap both from a PPP perspective and versus a time series of the real trade-weighted exchange rate (refer above graph). This has helped to support growth and is expected to last for longer, with the BoC likely to lean against any abrupt strengthening of the currency. However, we do expect further room for loonie gains against the APAC currencies, if as we expect, the Chinese slowdown deepens through 2017.

BoC firmly on hold: The lukewarm outlook suggests that the Bank of Canada will keep policy steady in the face of Fed tightening, which should nudge USDCAD gradually higher through mid-2017. The loonie remains highly correlated to oil prices, but it will likely not be able to resist broad US dollar strength (refer above graph).

Underperforming economy: The Canadian economy has bounced back in the second half of 2016 after the economic disruption caused by the Alberta wildfires earlier in the year. Economic growth, however, remains tepid overall. Business investment continues to be sluggish following the end of the energy sector boom, and export performance has not met previously upbeat expectations.

Newly announced mortgage tightening measures will also exert a negative impact on homebuilding activity. Overall inflation pressures remain limited, with the headline and core inflation rates under 2%. Low interest rates and recovering crude oil prices will likely help spur growth moderately in 2017.

Hence, add longs in a 1m2w 87.25 CADJPY AED digital put; alternatively, buy 4M sell 2M CADJPY OTM put at 80.0 strike in 1:0.761 notional.

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out