Last week EIA reported crude oil inventory at 8.0M which was a rise from previous 7.6M, as a result crude prices began dropping which in turn led to CAD losses. This depreciation in CAD in H2 2014 has underpinned majorly due to crude slumps.

Loonie has remained in narrow range between 1.3325 - 1.3130 on the verge of Fed's big event loonie eying on gains, bears of USDCAD began trimming gains as RSI showing divergence to the USDCAD uptrend.

So if anyone believes it can still be possible to pull out returns from this dubious scene from this pair, even though exhausted bulls who think long lasting non-stop streak of bull run to take halt at this point. Yes, that's quite achievable from iron butterfly strategy.

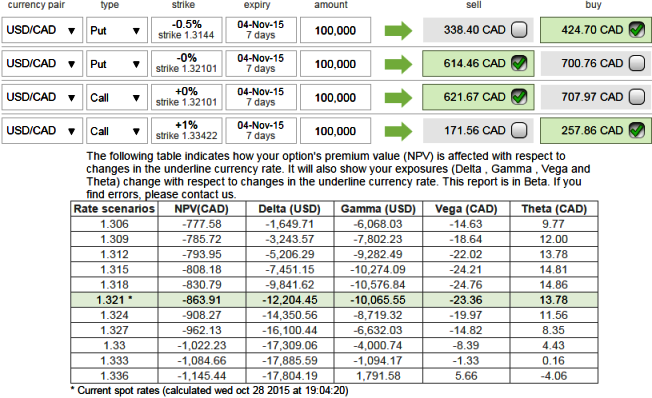

To execute this strategy, the hedger goes long on a lower strike Out-Of-The-Money put and shorts At-The-Money Put simultaneously short again on At-The-Money call and long on Out-Of-The-Money call, this results in a net credit to put on the trade.

Iron Butterfly (USD/CAD) = Long 2D (0.75%) OTM -0.25 delta Put (strike at around 1.3155) & Short ATM Put + Short ATM Call & Long 2D (0.65%) OTM 0.25 delta call (strike at around 1.3325)

Vega on Long OTM call was at 31.84, while vega on long OTM put was at 28.97.

Usually if the vega of a long option position is positive and the implied volatility rises or dips, the above stated option prices are directly proportional to the implied volatility.

So in this case vega both on long position is reasonably acceptable. It is desirable that at maturity the underlying exchange rate of USD/CAD to remain near short strikes in order to achieve highest returns.

FxWirePro: Loonie edgy ahead of crude inventory and FOMC - Long iron butterfly for cynic bulls

Wednesday, October 28, 2015 1:42 PM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings