NZDUSD speculators have begun paring extreme short positions, indicating NZD upside potential near-term. However, there is major event risk to navigate during the next week.

The catalyst for the reduction in short positions has been the improved mood in risky asset markets over the past two weeks (e.g. equities higher, US dollar lower). Today’s strong NZ GDP data will add to arguments for exiting shorts, and we would not be surprised to see the NZD trading at 0.6725 during the week ahead.

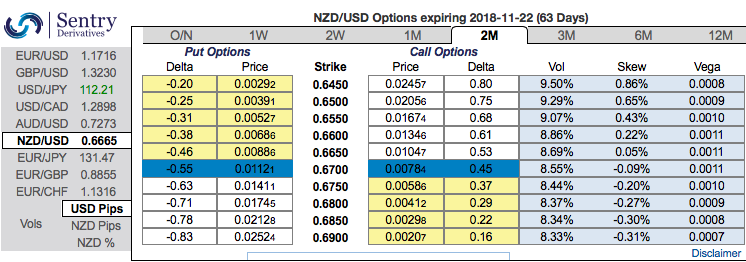

OTC Outlook and Options Strategy (NZDUSD):

Most importantly, OTC market hedging sentiments still favor bears as the positively skewed IVs of 2m tenors signify the hedgers’ interests for downside risks. The bids have stretched for OTM put strikes upto 0.6450 levels (above nutshell).

Accordingly, we advocate 2m (1%) in the money -0.79 delta put options, the rationale for choosing such derivative instrument is that the deep in the money call with a very strong delta would move in tandem with the underlying move. Deep in the money call with a very strong delta will move in tandem with the underlying.

Considering ongoing price rallies of kiwi dollar, it is wise to capitalize on such deceptive rallies and execute below options strategy:

Add longs in 2 lots of 2m (1%) in the money delta put options and short 2w (1%) out of the money put options.Thereby, the strategy addresses both upswings that are prevailing in short run and bearish risks in the long run by delta longs.

Currency Strength Index: FxWirePro's hourly NZD is inching at 155 (which is bullish), USD spot index is flashing at -99 levels (which is bearish), while articulating (at 10:59 GMT). For more details on the index, please refer below weblink:

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist