The RBA surprised by cutting in May, which suggests another cut to 1.5%, probably in August.

We expect the BoE’s bank rate is likely to be unchanged in this week’s monetary policy, as is the split of the vote. We think the Committee is likely to continue to look through EU referendum uncertainties and recent poor set of economic numbers in UK.

With both central banks behaving adversely in near term, we would expect the GBPAUD cross to consolidate around 1.9880 during the week ahead. Currently at 11-month highs, though, there is a case for higher, towards 1.9880.

Technically, as the pair drags upswings near 1.9667 which is above stiff resistance (21DMA), near-term pullbacks are seemingly still well supported DMAs. While these levels hold the trend we have been witnessing the last week or so from the 1.9304 region remains intact and is adding further cushion for retesting 1.9880 highs.

FX Option Strategy:

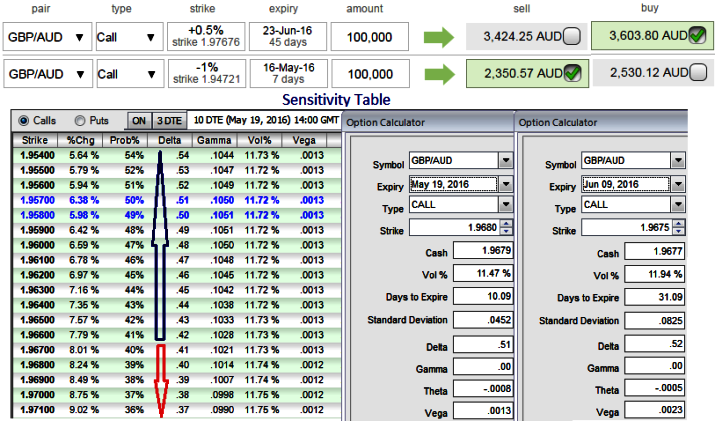

Execution: So, keeping the above fundamental and technical factors in mind, as shown in the diagram construct options positions so as to move in sync with sensitivity scenarios among various exchange rates.

The Execution: Go long in 1M 2W (0.5%) OTM 0.39 delta call while writing 1W (1%) ITM call with positive theta and delta closer to zero (both sides use European style options), this credit call spread option trading strategy is recommended when the GBPAUD spot price is anticipated to drop moderately in the near term and spikes up in long term.

How does it derive positive cash flows: Trader expects that the underlying spot FX price would drop to ITM strikes on expiration and thereafter bounce back again.

Thereby, you are speculating the spot GBPAUD’s struggle in short run by shorting, and lock in any dramatic upside risks caused by event risk in next two months which is especially Brexit fear via longs in OTM strikes which is why we've used diagonal expiries.

Risk/Reward profile: The return is limited by ITM shorts. No matter how far the market moves below that point, the profit would be the maximum to the extent of initial premiums received.

If the underlying spot FX price rises above the strike price of the higher strike call at the expiration date, then the credit call spread strategy suffers a maximum loss equals to the difference in strike price between the two options minus the original credit taken in when entering the position.

But after 1 week, if the underlying FX rates keeps flying then the payoffs from long calls would be exponential, the returns from long positions of this strategy in conjunction with premiums on short would add leveraging effects of the cashflows.

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons