Owning protection against European political discontent has been a key pillar of our bullish vol stance since late last year. Recent political developments in France and the implosion of what was considered to be a comfortable status quo (Fill on as one of the two run-off candidates) has reignited focus on political risks in the continent.

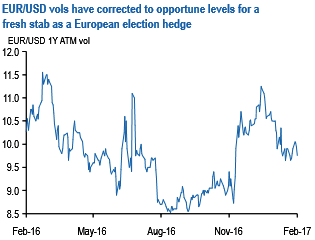

EURUSD vols do not reflect this increased anxiety, however, having dipped 1.5 -2.0 vols across the curve from their December highs (refer above chart).

Even though the probability of a catastrophic electoral outcome in France is low in our mind, the fact that EURUSD carries little-to-no risk premium for a Le Penn shock - short-term fair value models indicate that the currency trades about three cents stronger than Euro-US rate differentials and sovereign spreads would justify – is disconcerting; nor is positioning extreme short enough to suggest sufficient investor preparedness for a tail result.

We prefer outright widener in FRA/OIS as valuations appear cheap by historical standard and we see limited risk of inversion of FRA/OIS (FRA/OIS on 3s curve trading persistently negative). However, given the negative carry of outright widener, we currently hold FRA/OIS steepener between reds and greens. As we get closer to the French election we would be bias to roll the existing position into outright widener: we prefer the front end of the curve (like Sep17 of Dec17), where the negative slide is limited.

EURUSD cross currency basis in our view appears the least attractive way to position for funding stress under a Le Pen presidency with support from FN government and parliamentary majority. Current valuations in reds EURUSD cross currency basis are broadly in the middle of their range since QE started.

In vol, call skew in Bund options is currently not pricing the jump in implieds in a rally in Bund yields (discussed above). That is, OTM calls are cheaper compared to ATM calls indicating that market is still pricing a decline in implieds with yields. Therefore, as a hedge towards the tail risk, we would prefer buying Bund gamma via outright OTM call options.

For example, we recommend buying the 163 Apr Bund gamma via delta-hedged calls (implied vol around 3.8bp/day). The 163 strike corresponds to 10Y German benchmark Bund yield at around 15bp. Ideally, we would prefer options struck around 0% yield and with longer expiries (say the June options which expire in May).

However, on liquidity and gamma considerations we prefer the Apr Bund calls but note that we would roll these into May/June options as liquidity builds up in these contracts.

Buying only Apr Bund gamma outright is not advised but also versus selling maturity matched swaption gamma (Bund calls versus swaption receivers, delta-hedged). As swap spread directionality intensifies, Bund gamma would outperform swaption gamma. Historically, during the peripheral debt crisis episode of 2011, Bund/swaption implied vol spread had jumped to above 2bp/day.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis