Kiwis Q3 growth spikes by a mightier-than-anticipated 1.1%. However, the upward bombshell was more than offset by downward revisions to growth in the first half of the year, meaning the annual growth of 3.5% was a touch below expectations. As expected, growth was broad-based across industries. Meanwhile, the current account deficit was unchanged at 2.9% of GDP.

On the flipside, the Brexit-related dangers for the UK economy beyond initial confidence are yet to develop, and the scale and scope of BoE’s easing would cap GBP.

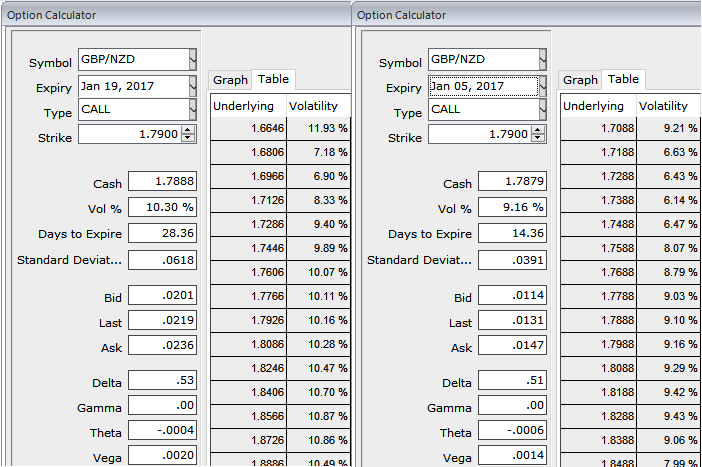

GBPNZD ATM IVs of this pair is trading shy above 9.15% for 2w and 10.3% for 1m tenors as the sideway trend likely to persist.

As the fundamental risks lingering on the both sides of currencies, we uphold our previous option strategy, which is the long put butterfly spread is advocated on speculative grounds that carries the limited returns and the limited risk. The strategy is taken when the options trader thinks that the underlying spot FX would not spike or drop much dramatically on expiration.

Three distinctive strikes are involved in this spread and it is constructed by buying one lower striking put, writing two at-the-money puts and buying another higher striking put for a net debit.

The execution: Buy (1%) 1m in the money put option, short 2 lots of 2w at the money put options, simultaneously; buy one more (1%) 1m out of the money put option.

The maximum return for the long put butterfly is achievable when the GBPNZD spot remains unchanged as stated in above range at expiration. At this price, only the highest striking put expires in the money.

The maximum loss for the strategy is limited to the extent of initial debit taken to enter the trade plus commissions.

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different