- Kiwi extends weakness ahead of RBNZ, dented by poor China trade data.

- New Zealand is highly dependent on China for its exports revenues and a big miss on imports weighing down on NZD.

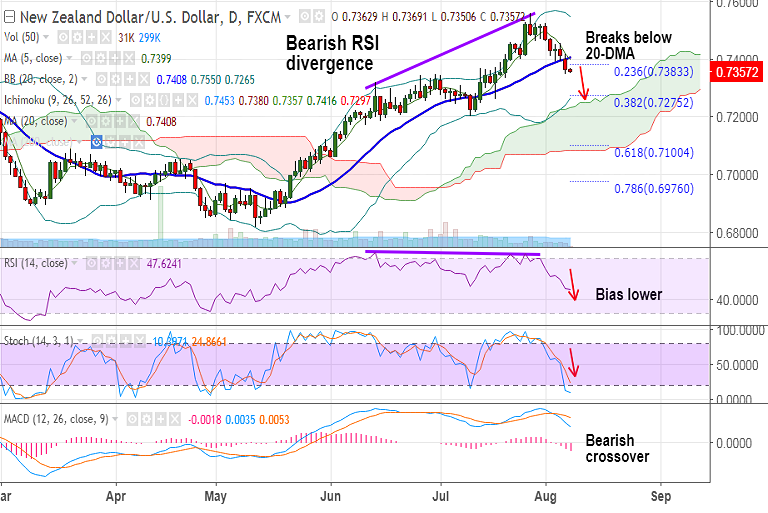

- Technical studies also support downside. We note bearish RSI divergence, rollover of Stochs and RSI from overbought levels and bearish MACD crossover.

- NZD/USD has shown a break below 20-DMA at 0.74 levels. Scope now for test of 50-DMA at 0.73.

- Violation at 50-DMA could see drag upto cloud top at 0.7233. Bearish invalidation only above 20-DMA.

- Focus on China’s inflation data due tomorrow along with RBNZ policy decision.

- Markets also awaiting US JOLTS job openings and IBD/TIPP Economic Optimism for fresh impetus on the buck.

Support levels - 0.7333 (July 20 low), 0.7303 (50-DMA), 0.7233 (Cloud top)

Resistance levels - 0.74 (5-DMA), 0.7408 (20-DMA), 0.7458 (July 21 high)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-Kiwi-dented-after-big-miss-in-NZ-employment-change-short-NZD-USD-rallies-833168) has hit TP1&2.

Recommendation: Book partial profits at lows. Lower stops to 0.74. Hold for further downside. TP: 0.7335, 0.73

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at -77.1959 (Neutral), while Hourly USD Spot Index was at -77.1959 (Neutral) at 0520 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest