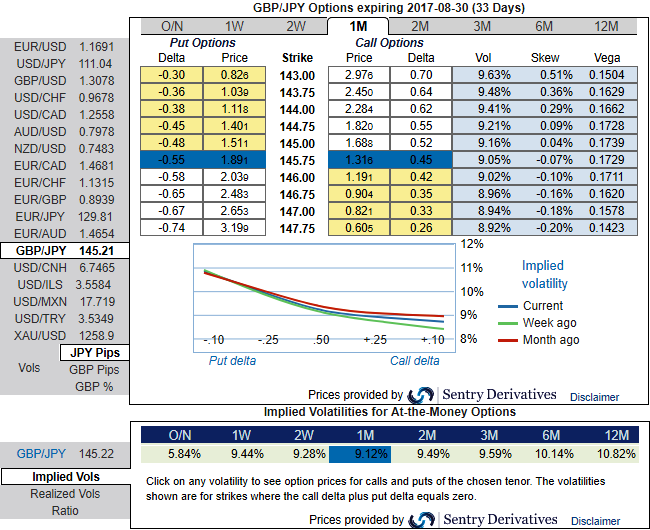

Please be noted that the positively skewed IVs of GBPJPY of 1m tenors signify the hedgers’ interests in OTM put strikes. Whereas IVs of these tenors are just shy above 9.12% which is highest among G7 currency space, while higher IVs with positively skewed IVs signify the hedgers’ interest for both OTM call/put strikes. In usual circumstances, long option position needs higher IVs for significant change in vega. Hence, we capitalize on buzzing IVs and improve odds on options below strategy.

With this interpretation, one can judge whether the options with a higher IV cost more. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. If IV increases and you are holding an option, this is good.

Thus, we advocate weighing up above aspects as we eye on loading up with fresh vega longs for long term hedging, more number of longs comprising of ATM instruments and OTM call shorts in short term would optimize the strategy.

The aggressive volatility investors want to capture GBP should consider buying ATM put instruments and/or being long of the smile convexity, against ATM volatility.

Further GBPJPY upswings and/or abrupt weakness suggest building a directional strategies and volatility patterns at the same time.

Contemplating IV skewness and ongoing technical trend in the consolidation phase, we foresee the value of OTM options would likely rise significantly as the IVs seem to be favoring long legs of ATM strikes.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -10 levels (neutral), while hourly JPY spot index was at shy above 145 (extremely bullish) at the time of articulating (at 06:09 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close