Key Economic Fundamentals:

The yen eased further in Asia on Monday after retail sales data came in better than expected with investors focused squarely on the prospect of a Federal Reserve rate hike as soon as next month.

Japan prints upbeat numbers of retail sales, for April it fell 0.8%, less than the 1.2% decline expected YoY.

On data front, Canadian current account and GDP are scheduled to be released today and tomorrow respectively. On the flip side, Japanese unemployment rate, industrial production, manufacturing PMIs and consumer confidence are on data radar.

The Japanese Yen finished last week lower against the majority of G10 FX as traders react to ECB & anticipate the BoJ & Fed this week.

OTC outlook & Hedging Framework:

CADJPY spot is testing to approach minor resistance at 85.175 levels and may struggle for sustenance and as a result CFDs of this pair slightly have been drifting down.

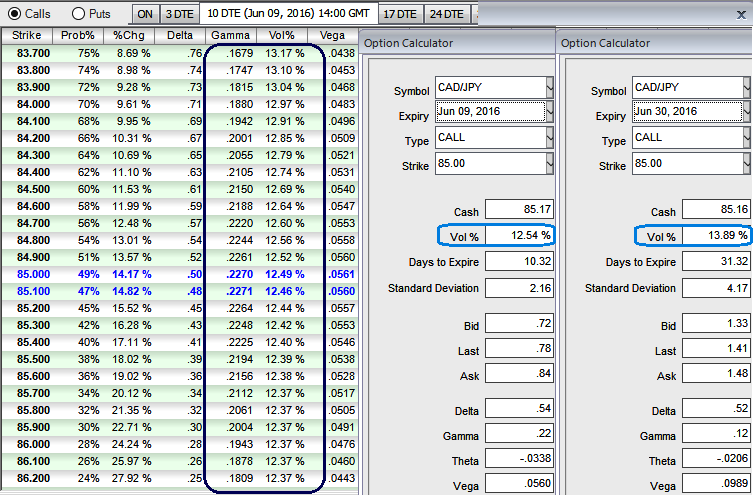

The implied volatility of 10D CADJPY ATM contracts 12.54% and creeping up at 13.89% for 1m tenors.

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Since ATM IVs are growing in snail's pace, shorting expensive OTM or ATM calls with shorter expiries would likely result in positive cash flow on expiration as the pair is testing supply zones and seems unlikely to show dramatic break out above.

On the contrary, we trust pair may move in either direction but capitalizing on steady IVs with no significant data drivers in short run that could bring in considerable IV spikes, Gamma of OTM strikes and corresponding IVs also in sensitivity table are reducing, thus such OTM instruments seems beneficial and deploy in our strategy.

The Execution:

Go long in CADJPY 1M at the money delta put, Go long 1M at the money delta call and simultaneously, Short 2W (1%) out of the money call with positive theta or closer zero.

If one is bearish to very bearish, then one can even eye on writing ATM or ITM calls as well as an alternative to shorting the underlying spot FX.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation