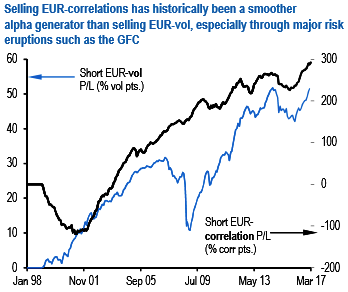

EUR correlations boast of a better track record as a systematic short than EUR vols, especially during financial market disruptions (refer above chart) which are once again attributable to their being long/short option packages that enjoy some degree of protection from their long vol components.

LHS shows stylized returns of selling an equally weighted basket of EUR/G10 3M volatilities (9 straddles) every month, and rolling into fresh 3M shorts at the end of the month. Monthly vol returns calculated simplistically as 3M implied volT – (2/3)*2M implied volT+1M – (1/3)*1-mo realized volT+1M. RHS plots stylized returns of selling an equally weighted basket of EUR/ CCY1 vs. EUR/CCY2 3M correlations within the G10 universe (36 combinations in all) every month, and rolls into fresh 3M shorts at the end of the month. Monthly correlation returns calculated simplistically as 3M implied corrT – (2/3)*2M implied corrT+1M – (1/3)*1-mo realized corrT+1M.

As inviting as the RV set-up is, all of the above can turn out to be academic if option markets are efficient enough to hammer vols and correlations to or below their forward levels in an as-expected election outcome scenario.

Hence we refrain from a forensic examination of value within the EUR-correlation universe just yet, and instead, flag EUR correlations as a potential class of alpha generators to keep on the radar should pockets of opportunity still remain next week.

Only one subset of this family – involving EURCHF vs. another EUR-cross – strikes us as reasonable enough to engage in selling. even before the next round of voting in France (which is scheduled on May 7th) because of what we consider a particular asymmetry of the EURCHF cross: potentially significant exposure to a large EUR decline (or maybe not even then if the SNB severely clamps down on disruptive franc strength), but high likelihood of muted participation in a Euro rally on account of structural appreciation pressure on the franc as there are limits to the central bank’s ability and willingness to continue recycling Switzerland’s best-in-class current account surplus.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary