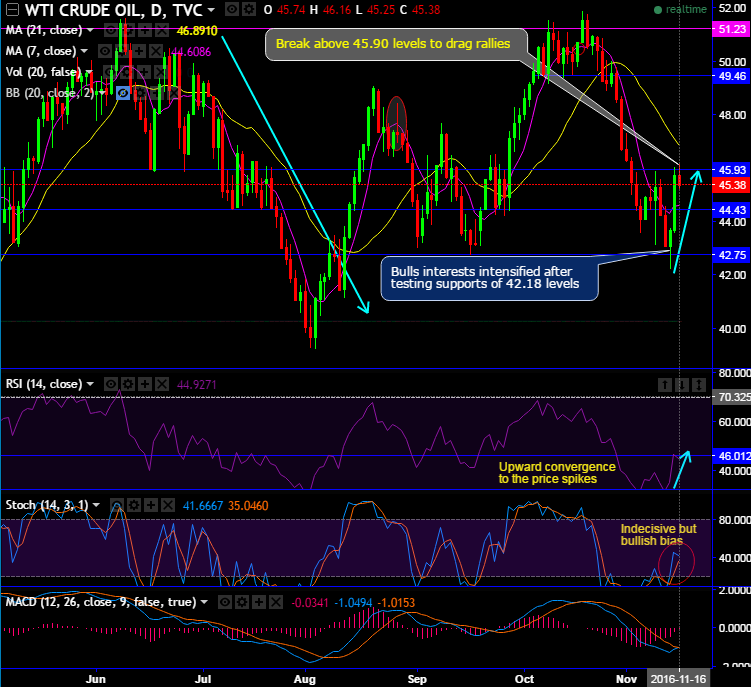

Last two days’ WTI crude price rallies are now restrained at the resistance of 45.93 levels, and any break above these levels to drag rallies. Bulls interests intensified after testing supports of 42.18 levels.

RSI evidences the upward convergence to the price spikes. While stochastic curves have been indecisive but bullish bias.

On monthly plotting, Dragonfly Doji formed in an attempt of bottoming out at 33.87 levels, consequently, its bullish effects retrace in a consolidation phase more than 23.6% fibos.

MACD signals the bull swings to extend to substantiate the above bullish pattern candle.

On the contrary, a shooting star occurred at 46.74 levels, as a result, it evidences dips below support at 23.6% fibos, For now, the upswings were restrained at 21EMAs.

That is where, the prices struggling to clear above 23.6% and 21EMAs, but any breaks above and its sustenance could be deemed as the previous consolidation phase to transform into continuation pattern.

Bears resume today again at above-stated resistances of 45.93 to bid for more dips ahead of the U.S. EIA’s release of its weekly report on oil inventories at 15:30GMT today, analysts forecasts for an increase of 1.48 million barrels. We don’t encourage long-term short build ups hereafter, well on the flip side, with dubious stances due to above candle patterns (whether it is shooting star or dragon fly doji) we remain sideways to see the breaks and sustenance above 50.50 levels.

WTI crude prices for December delivery on the NYME touched an intraday high of $46.18 a barrel, the most since November 1st week.