USDCHF has tumbled to remain in the range which was anticipated by FxWirePro and accordingly, advocated hedging vehicle.

For more details, visit below weblink:

If you could observe the quantum of slumps in the underlying spot FX, you could very well imagine how much this short hedge would have mitigated the bearish risks (constantly, tumbled from the highs of 1.0355 to the recent lows 0.9550 levels). Currently, testing support at 0.9566 (rising wedge baseline).

Well, for now, the question is would it turnaround from this levels or sell-off in USDCHF was too little, too late for our put spread that expired OTM.

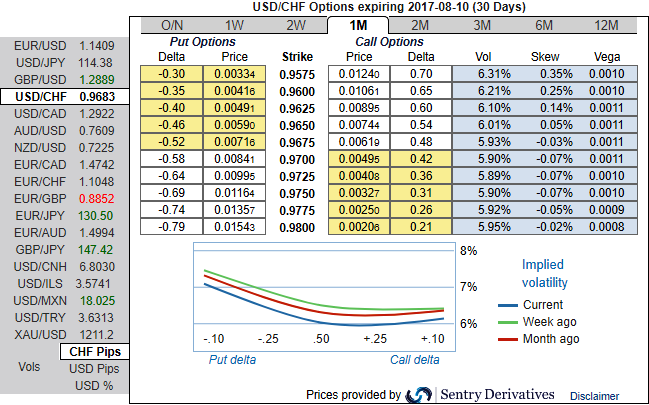

Please be noted that the ATM implied volatilities are shrinking away (3rd least among the lot), faded at 6.1% in 1m tenor and 6.5% in 3m tenors.

The 1M IV skews signify the importance of OTM put strikes in OTC FX markets.

While risk reversals of 1-3m tenors have been neutral but moving in sync with IVs and spot FX movements.

Whereas, we see no significant changes in 1m bearish hedging sentiments in OTC FX market of this pair.

25-delta risk reversals evidence no disparity in volatility and prices, between puts and calls on the most liquid out of the money (OTM) options quoted on the OTC market.

For risk-averse traders, the short position in USDCHF diagonal options structure is maintained as we do not believe that the Italian election in H2 would be a game-changer for USDCHF insofar as it will do little to resolve the powerful balance of payments disequilibrium in favor of CHF. That being said, we are close to our stop and would step aside for a period should this be triggered.

In all, we are comfortable with the existing cash position in EURCHF.

Long CHF - call spread versus USD; hold vs EUR in the spot, hold a 2m/1m 1.0010 - 0.95 USDCHF debit put spread.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays