The yen recovery is probably not over yet and USD/JPY upside is likely to be delayed until later in H2, as neither a sudden acceleration in the Fed tightening path nor imminent BoJ action seem very likely.

After losing credibility in setting negative rates and facing sharp yen appreciation, the Bank of Japan has to wait before contemplating any new bold action.

In that context, the risk of policy mistakes remains elevated, and it is presumably dangerous for the central bank to react against an unfavorable market environment.

The issue of timing is tricky, and presumably, it would be more successful acting decisively in a context of mounting US yields and performing risk assets than in fighting the market in the midst of a risk-off phase.

Our Japan economists are also doubtful that the BoJ will implement additional QQE. The forces that could dampen the yen appreciation are now pretty limited, so the recovery probably has further to go. As a result, USD/JPY could go even lower.

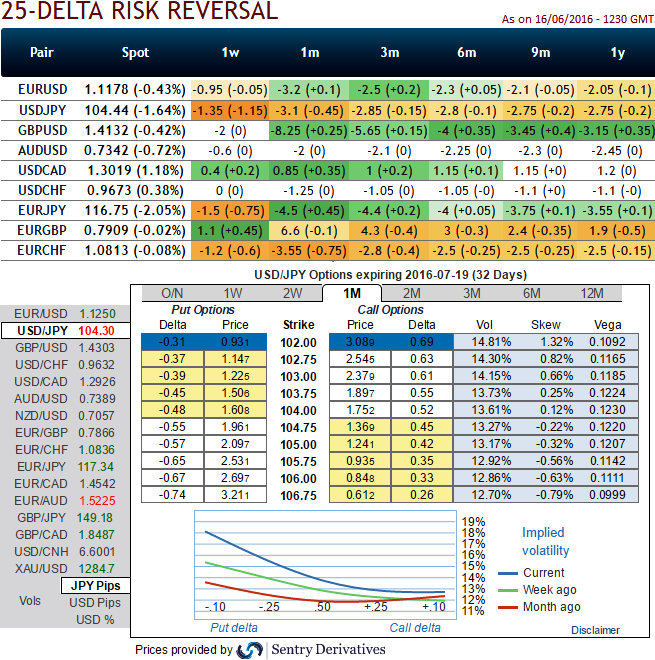

OTC observation (G10 space):

As you can probably observe, options of OTM put strikes evidence higher skews with higher vols.

The ATM IVs of 1m expiry have reduced to 13.55% after the central banks events that have not surprised anything.

While delta risk reversal of this pair signals more bearish pressures in long run by adding up more bearish hedging positions.

Why do we think USDJPY sensing pressures for downside risks: The delta risk reversals evidence the deep negative difference in volatility on various OTM strikes, and therefore the price difference between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market.

Since these FX options risk reversals take volatility analysis one step further, practise them not to predict market conditions but as a gauge of sentiments on a specific currency pair.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX