Reading between the lines: The RBNZ may have cut rates early in December but it also hinted the easing cycle may be over and that turned what ordinarily would be a currency negative event (a 25bps cut that was only 60% priced in ahead of the meeting) into something currency-positive. Some price recoveries from last couple of days could be utilized by employing short term put writings and derives certain returns.

"The rise in the exchange rate is unhelpful and further depreciation would be appropriate in order to support sustainable growth" but in the same statement the Bank says it expects to achieve its policy target "at current interest rate settings", so there is no credible rate cut threat to drive NZD lower, to come into a conclusion about RBNZ's move we should wait until 28th Jan.

Although we've been observing bearish indication in this week any unexpected upswings in short term could also to be utilized in our below strategy.

With current spot FX at 78.739 levels, the strategy takes care of long term basis hedging motives and so far trend likely to favor our short puts as the underlying pair was rallying.

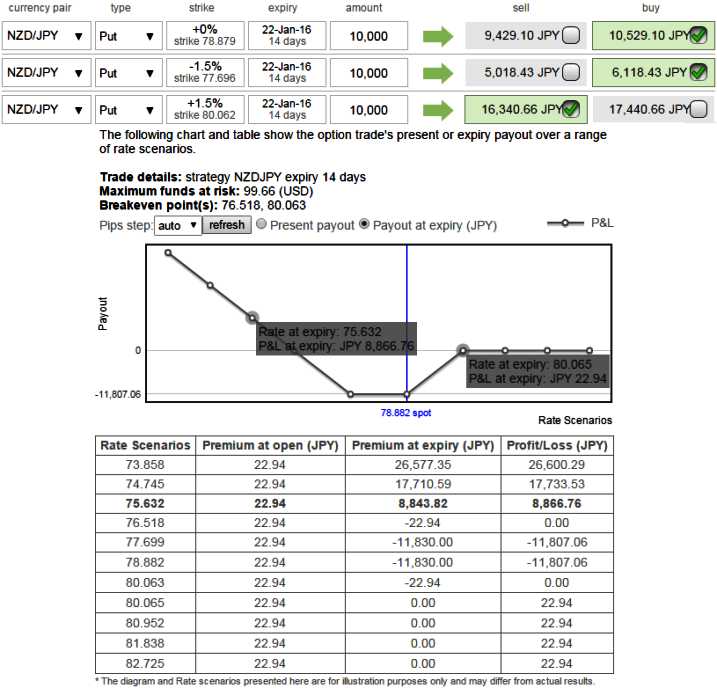

So, eyeing on leftover minor upswings or to remain sideways short 2D 1.5% ITM put option, thereafter the functionality of active longs in puts could be expected, so go long in 2W ATM -0.50 delta put options and one more long position on 1M (-1.5%) OTM -0.39 delta put option would prove to be hedging materials.

The strategy profits in 3 directions: When the pair rallies upwards (strongly or moderately), remains stagnant or goes downwards strongly. Indeed, the Short Put Ladder Spread has made profitable 4 out of 5 possible outcomes which make its probability of profit extremely high.

Maximum returns are limited to the extent of initial credit received if the NZDJPY rallies above the upper breakeven point (BEP) but large unlimited profit can be achieved should the underlying exchange rate of NZDJPY makes a vivid downswings below the lower BEP.

Note: Expiries used in the diagram is only for demonstrated purpose only, use it accurately as stated above.

FxWirePro: Is RBNZ easing season over? Capitalize on NZD/JPY abrupt rallies to deploy shorts in put ladder for hedging

Friday, January 8, 2016 7:06 AM UTC

Editor's Picks

- Market Data

Most Popular

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist