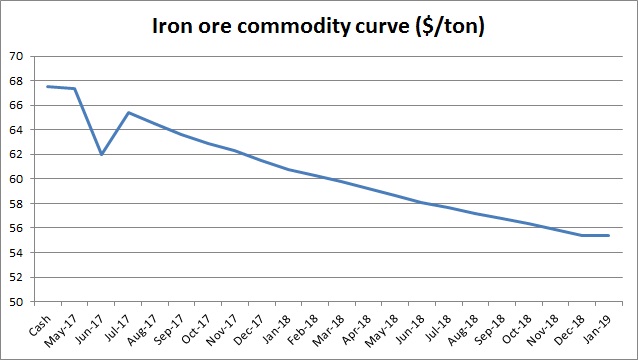

After a short recovery since mid-April when the iron price reached as low as $61 per ton (CME), the most important ingredient for steelmaking suffered another blow in China today. In China’s Dalian Commodity Exchange the iron ore price declined by almost 8 percent to trade at yuan485 per ton or $70.33 per ton. After last year’s stellar performance, the outlook for iron ore is quite grim; the current backwardation in the market is reflecting that.

While the cash is trading around $67.5 per ton, the June contract is trading as low as $62 per ton and December 2018 contract is trading at $58 per ton. Last year’s outperformance by Iron ore as the price increased by more than 60 percent, has led to an increase in additional production and supplies in the market, especially from Australia. In addition to that, the recent executive order signed by President Trump to investigate US import of Steel has also been weighing on price. Even the Reserve Bank of Australia (RBA) has warned against Iron ore price by suggesting that there could be a further decline in price.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022