Loonie has remained in narrow range between 1.3435 - 1.3224 on 06/11, on the verge of Fed's big event dollar eying on gains, but bears of USDCAD began trimming gains as it touches the intermediate highs of 1.3370, so advise is not to get stuck in bull trap.

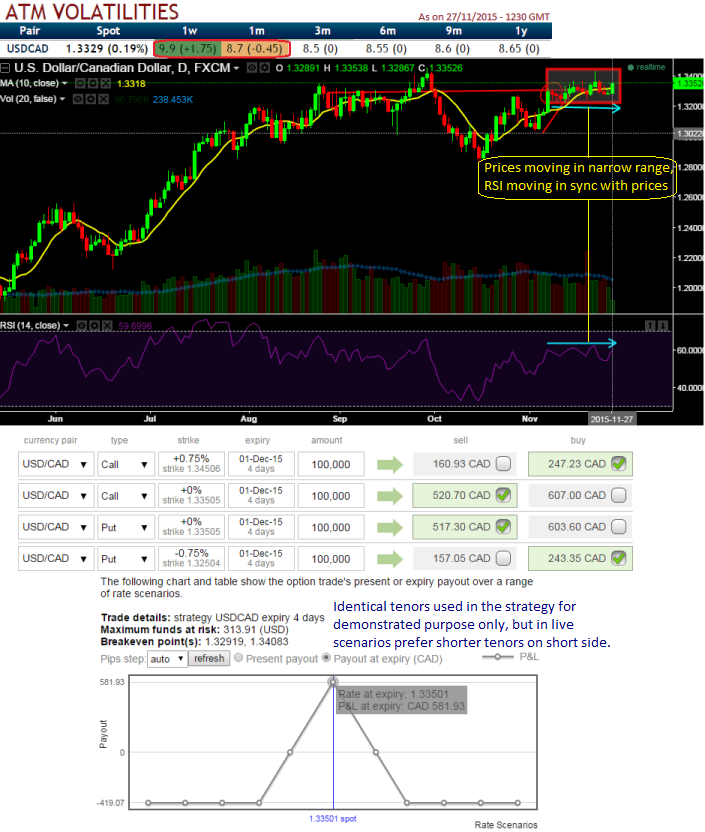

While nothing much is luring in OTC market as IV seems to be lackluster from last fortnight or so. (see IVs are decreasing gradually).

So if anyone believes it can still be possible to pull out returns from this dubious scene from this pair, even though exhausted bulls who think long lasting non-stop streak of bull run to take halt at this point. Yes, that's quite achievable from iron butterfly strategy.

To execute this strategy, the hedger goes long on a lower strike Out-Of-The-Money put and shorts At-The-Money Put simultaneously short again on At-The-Money call and long on Out-Of-The-Money call, this results in a net credit to put on the trade.

Here goes the strategy this way,

Long 4D (0.75%) OTM -0.25 delta Put (strike at around 1.3251) & Short 2D ATM Put + Short 2D ATM Call & Long 4D (0.65%) OTM 0.25 delta call (strike at around 1.3325)

Vega on Long OTM call was at 44.27, while vega on long OTM put was at 42.96.

Usually if the vega of a long option position is positive and the implied volatility rises or dips, the above stated option prices are directly proportional to the implied volatility.

So in this case vega both on long position is reasonably acceptable. It is desirable that at maturity the underlying exchange rate of USD/CAD to remain near short strikes in order to achieve highest returns.

FxWirePro: Iron butterfly best suitable for loonies’ narrow range trend – vega gains on IV factor

Friday, November 27, 2015 1:57 PM UTC

Editor's Picks

- Market Data

Most Popular