The UK's vote to leave the EU has ushered in what looks set to be a long phase of uncertainty. The implications of the vote are broad, with very direct economic and political fallout for the UK and Europe. They also signal the strength of anti-globalization movements more generally.

Big investment banks with their European headquarters in London will start the process of moving jobs from the U.K. within weeks of the government triggering Brexit, a faster timeline than their public messages of patience would imply, according to people briefed on the plans being drawn up by four of the biggest firms.

Dismayed by the lack of a clear plan to protect the U.K.’s status as a global financial hub, executives are planning for the worst -- that they will lose the right to sell services freely around the European Union from the City, said the people, who asked not to be identified because the plans are private.

Facing a long process with potential waits for regulatory approvals before workers can pack their bags, banks want to start quickly in order to have new or expanded offices set up in Europe before the end of the two-year Brexit negotiation period.

Goldman Sachs predicted that the pound could fall as low as $1.20, Deutsche Bank has predicted $1.15, while former PIMCO big dog Mohammed El-Erian thinks that parity with the dollar could beckon for sterling when Britain decided to sort its EU membership out soon.

We expect GBP weakness against the EUR to last only one quarter as emphasis turns increasingly to the political stability of the rest of Europe.

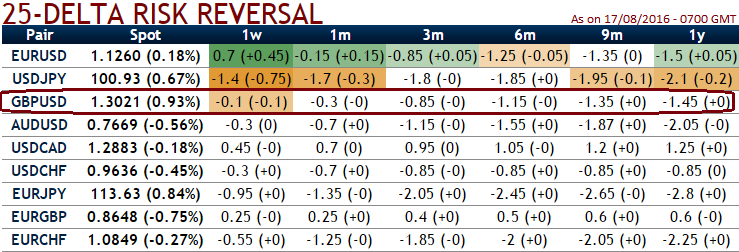

While the OTC options market appeared to be more balanced on the direction for the pair over the 1m to 1y time horizon as hedgers have been cautious on long-term downtrend that has lasted since mid-April 2013 and as a result delta risk reversal for GBPUSD has again been turning into negative, while the UK current account balance data go back to 1946 and BoE’s easing bias adding pressuring current trend.

The annual deficit (just over £100bn in 2015) didn’t get above £1bn in a single year until 1973, so we reckon the pre-1946 story can be largely ignored. Since 1946, the cumulative deficit is £881bn, and it’s getting bigger and bigger.

Hence, we think the foreign trade bills in pounds denomination are so needy to be hedged for downside risks and so is evidence in OTC hedging arrangements.

Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility