Since tumbling from its September highs, below 0.9226, the pound has consolidated in a narrow 0.9226 to 0.8686 range against the euro.

Looking ahead, ongoing Brexit negotiations and central bank policy expectations are likely to remain the key drivers of the currency pair. With regard to Brexit, the EU has determined that ‘sufficient progress’ has been made, such that discussion can now move on to the future trading relationship between the bloc and the UK and any potential transition period. Comments from Brexit Secretary David Davis and EU Chief Negotiator Michel Barnier have reinforced the challenges both sides face in coming to a comprehensive agreement. On the interest rate front, we expect the Bank of England (BoE) to proceed cautiously, following its 25bp hike in November. We anticipate the next hike in UK Bank rate to be in August 2018. In contrast, we see the European Central Bank (ECB) leaving interest rates unchanged next year, although it is likely to wind down its asset purchase programme.

GBPUSD in a broader perspective, the clear breakthrough 1.3900 has added further evidence that the bear cycle that started back at 2.1160 in 2007 completed at 1.1490. On a multi-year basis, this suggests mean reversion back to 1.50-1.60. However, sharp pullbacks on negative Brexit news remain a high risk, with key supports rising and now in the 1.35-1.30 region.

On the other hand, we still cannot rule out EURGBP re-test of the 2008 highs at 0.9802. However, the longer we remain within this medium-term range under 0.9300-0.9710 the risks of that reduce. A decline through 0.8250 key support would negate this, and suggest a move back initially to 0.8000 and then the 0.7500 regions.

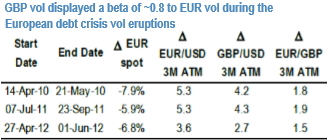

GBP vol: The experience of vol flare-ups during the European debt crisis suggests that the beta effect of a jump in EUR vols during a political shock overwhelms the vol-dampening impact of safe-haven demand for sterling and leads to a jump in GBP vol with a beta of 0.8 to EURUSD vol (refer above nutshell).

Yet, GBP O/N vols for the event are tiny this time around (7.0, less than half of EURGBP at 16.3 and EURUSD at 19.3), and the 1M/2M vol term structure is inverted after the surge in the spot to 1.40.

GBPUSD 1M1M FVAs could serve as reasonable proxies to play the Italian event and can work event absent an electoral upset, say in the event of a broad dollar correction or a meaningful charge higher in the spot beyond 1.40. Buy EURGBP 6M6M FVA on UK policy uncertainty, flat vol curve.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One