While the base metals analysis focuses on how much additional outright demand will likely be gained by changes in automotive technology in the future, conclusions in PGMs are more mixed with palladium looking set for a bit of a windfall of demand over the next decade, largely at the expense of platinum, before both begin to feel the effects of increasing BEVs in the years beyond our forecast window.

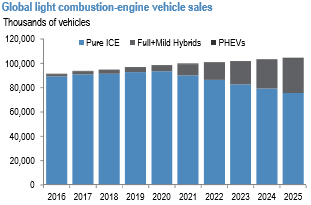

While our baseline auto assumptions see global pure ICE sales beginning to decline YoY in 2021, from a PGM perspective, it is important to highlight that sales of vehicles containing a combustion engine continue to grow through 2025, given our estimated strong growth in hybrid vehicles (refer above histogram diagram which is given as per JP Morgan’s estimates).

Jangada Mines has been in the limelight for a speculative buyout. Jangada Mines Scoping Study announced yesterday on the Pedra Branca platinum group metals (PGM) project highlighted the economic potential of South America's largest and most advanced PGM project, located in north-eastern Brazil. Results demonstrate the economic viability of a potential 1.1Mt pa operation producing some 34,000oz of palladium, platinum, and gold (2 PGM + Au).

In addition to PGM mineralization, Pedra Branca contains significant amounts of technology metals including nickel, cobalt, and chromium as well as copper.

Assuming an initial CapEx of US$38.4 and a life of mine of 13 years, a NPV of US$158.4m with an IRR of 80.5% and a payback period of 1.3 years was calculated using a 10% discount rate and a five-year historical average for platinum, palladium, gold, copper, nickel, chromium and cobalt.

Trade recommendation: (Stay short Jan’18 NYMEX platinum)

As gold loses its luster in 4Q, we think the recent support platinum enjoyed from July through early September will continue to break down as well, especially given that the fundamentals for platinum remain non-compelling, to say the least.

Moreover, as fresh longs established amidst the rally in prices over the last couple months have driven net positioning long again to nearly 24,000 contracts, almost level with the peak in net length reached earlier this year, we see length approaching stretched levels.

As such, we see prices declining to average $930/oz in 4Q’17 before weakening further to $910/oz in 1Q’2018. On September 27, 2017, we elected to take half profit on our position and trail our stop for the remaining half unit to $950/oz as prices approached a key technical make or break at between $923/oz and $890/oz.

Went short Jan’18 NYMEX platinum at a price of $978.90/oz in mid-September. Squared off half position and booked profit at 924.10/oz for a gain of 3.0%. Uphold the rest of the trade volumes for a trade target is $880/oz with a stop for the remaining 0.5 units at $950/oz.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data