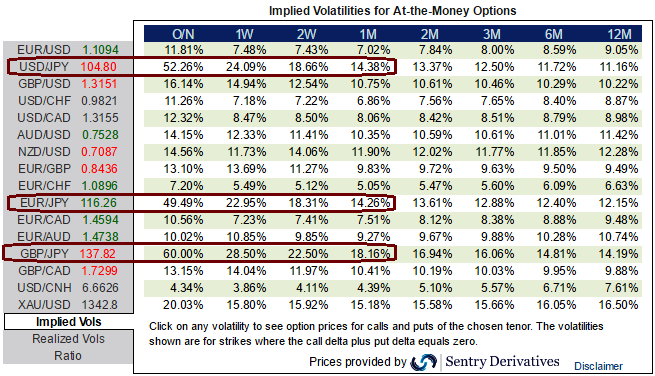

Please have a glance IVs of Yen crosses (see highlighted portion of yen crosses), 1W ATM tenors have spiked above 22% almost all yen crosses, and this turbulence in OTC market is majorly due to tomorrow’s monetary policy decision by BoJ.

This week is a busy one for Japan data watchers with many June releases including CPI, housing starts, and FX markets digesting the better than forecasted trade balance data, while the key focus should be on Friday’s BoJ policy meeting.

A successful option strategy generates decent leverage while controlling risks. Different structures will produce various risk reward profiles. A central idea behind the risk reward notion is that for a given market scenario, the cheapest strategy will not necessarily be the most profitable. Indeed, the leverage of a strategy is a more pertinent decisional parameter than its cost.

As you know that if IVs increase and you are holding an option, this is a good news for them and you should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

Well, in above highly volatile case Yen crosses the leverage of a given strategy cannot be a single number but is a full leverage profile. This metric not perfect, as the maximum leverage is finite only for strategies with a capped profit but infinite for single vanillas (unlimited gain) and zero cost strategies (no premium). It is, however, suitable for our purpose of comparing strategies.

The easiest way to define the leverage is to divide the strategy payoff by its cost, based on the spot level at expiry. The obtained function relates the strategy leverage to all terminal spots.

With a clear slowing in the inflation trend and inflation expectations among both corporates and households, and Brexit, we find it hard to imagine whether the BoJ would ease this week or not, given its frequent statement “the central bank would observe risks to economic activity and prices, and take easing measures in terms of three dimensions—quantity, quality, and the interest rate.

If it is judged necessary for achieving the price stability target” (from June Statement on Monetary Policy). The economy has struggled with deflation for two decades. Even after the BOJ's massive qualitative and quantitative easing (QQE) program and venture into negative interest rates territory, the Asian economy hasn't been able to boost domestic consumption and shake off deflation.

Indeed, according to the Japan Center of Economic Research, 86% of 42 economists surveyed between June 27 and July 4 expect policy easing on Friday. No action by the BoJ would erode its credibility on achieving the inflation target and tighten monetary conditions through JPY appreciation.

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices