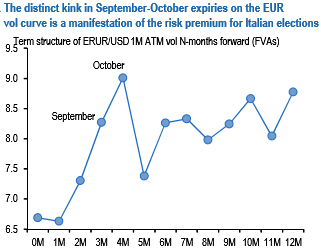

Euro options and election risk premium – the Italian edition Election risk premium is once again the story in Euro options, this time a potential September/October vote in Italy. EUR-and EUR-cross options spanning September expiries have smartly re-priced higher following the French election playbook, with the result that vol curves display a distinct, by-now-familiar kink in the 3M-6M segment (refer above chart).

To judge if this kind of event risk premium is justified, it is first useful to recall the macro view of the implication of an Italian vote for the Euro: the most menacing issue for the currency is that Italy is the only country in the Euro area where Eurosceptic parties collectively poll close to 50%, so sufficient to form a government assuming they could reconcile policy agendas.

The offset is that the Italian constitution must be changed through a lengthy procedure before any EMU referendum can be held since such plebiscites are not allowed on treaty issues; our European team considers the probability of a referendum on the single currency remote. This baseline suggests to us that the premium for Italian elections should not exceed that for the French, and will count as a strong fade if their relative ratio starts approaching towards 1.

The forward vol priced between 22 Sep –23 Oct (the two dates mentioned in the press) in EUR/USD is currently 8.9, a good 2 vols over spot ATM, but only 50% of the peak absolute forward vol spanning the two French election rounds reached in late February (refer above table).

On the whole, Euro-bloc FX options discount close to 60% of the high in French election risk, and it would not surprise to see this fraction inch higher over coming weeks as certainty around the event crystallizes. It is too early in the event calendar cycle to mull fading the first uptick in risk premium; if anything, we are biased to be long of the relatively underpriced camp in table – the top 3 per the last column would constitute EURCHF, EURJPY, and EURUSD, of which we are currently running EURUSD longs via 1M1M FVAs outright and in long/short format via EURUSD – EURSEK vol spreads.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges