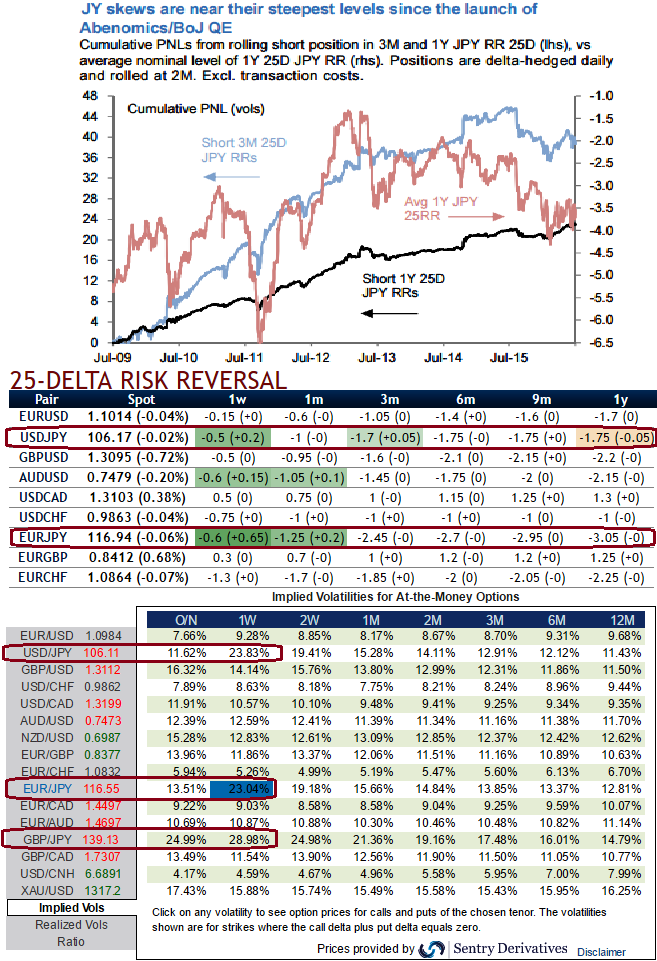

We hold short JPY skew risk as valuations are stretched. Short-dated tenors are exposed to BoJ under delivering this week, but longer dates offer consistently rich risk premia to fade.

JPY vol risk premia are extreme ahead of next week's BoJ meeting, with front end vols at their most elevated since Oct 2008. 1W expiries covering the BoJ are marked at a whopping 26.6, and the 1M-3M curve is at its most inverted at -2.5vols. JPY risk-reversals are also a pocket of acute stress, having steepened to multi-year highs.

Selling rich JPY skews looks compelling as the market is digesting Brexit and an uneventful Upper House election, and the attention turns to prospects of concerted balance sheet expansion and fiscal spending.

Even if the size of the fiscal package disappoints and USD/JPY resumes its grind lower on cleaner positioning, valuations, and historical back tests are supportive of short positions in JPY skews. We have previously noted the abrupt widening in JPY risk-reversals, especially leading into the Brexit, and found them to be at stretched levels.

JPY RRs have narrowed as JPY softened on chatters of “helicopter money”. Please be noted that this move, along with the pickup in USD/JPY since early July owes primarily to unwind of JPY longs and widening in USD vs JPY real rates spreads

The pairs which combine cheapest valuations and best historical returns are highlighted. We hold EUR/JPY 3M RR entered 20-Jun and picked up 1Y CAD/JPY and NZD/JPY RRs on 13-Jul. Sellers of JPY RRs will find their best prospects in EUR/JPY and CAD/JPY at the moment.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data