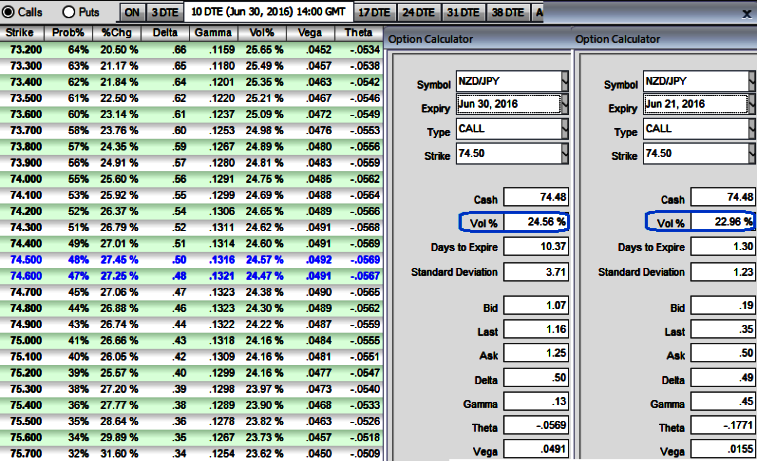

The current implied volatility of NZD/JPY ATM call options are at 22.96% and it spiking higher at 24.56%.

Effect of volatility on the value of both options would increase as volatility spikes and would decrease as volatility shrinks away.

Despite previous RBNZ surprises cut of 25 bps previously, the strength is considerable that offers FX rates of this pair now to retest at 75.961 and bids at 74.190 levels.

But this month the central month has maintained status quo and deferred their policy action where one more rate cut was due.

Therefore, at this baffling circumstance we’ve devised suitable option strategies to both for long-term hedging and short-term speculation during higher IVs.

Hedging Framework:

Spread ratio: (Long 1: Long 1)

Execution: Go long in NZD/JPY 1M (1.5%) in the money +0.66 delta calls, simultaneously go long in 1M (1.5%) in the money -0.65 delta puts.

Huge returns for this strategy is achievable when the underlying spot FX price creates a very strong move in either direction at expiration.

The move in the underlying spot FX price must be strong enough such that either the long call or the long put rise enough in value to offset the loss incurred by the other option expiring worthless.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX