The central bank of Norway left its benchmark interest rate on hold at 0.5% on May 12th, 2016 as widely expected, following a 25 bps cut in March.

Policymakers said developments since last meeting were in line with expectations: inflation remains high although a stronger krona may contribute to the slowdown and the rise in oil prices may reduce uncertainty.

Yet, policymakers reinforced they would not hesitate to cut rates further to boost growth.

Forward rates price in smaller chance of rate cut.

NOK/SEK breaks 1.00, EUR/NOK below 9.25 with scope for deeper retracement.

NOK cheap vs G10 counterparts in trade weighted terms, higher oil price reinforces currency appeal

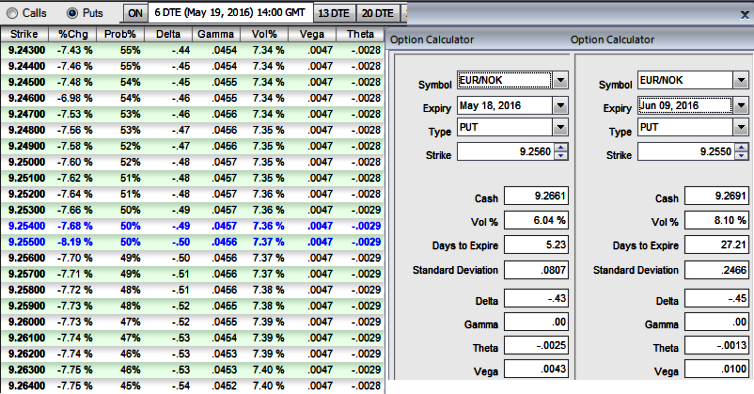

You can observe ATM puts of EURNOK is shrinking below 8%, the tepid IV implies that the market thinks the price will not move much.

Although in short term the UK EU referendum poses a slightly downside risk to NOK, while a more sustainable NOK appreciation could materialize in H2. We target EUR/NOK at 9.28 in 1M, 9.15 in 3M, and 9.40 in 6 M.

With the current outlook we therefore still expect fundamentals and relative rates to limit the EUR/NOK downside potential in the coming 6M. Also Brexit fears will, in our view, be a positive for the cross.

We recommend hedging short term NOK payables via risk reversal strategies and long term payables through FX forwards (preferably with 3m tenors).

Simultaneously, it is also advisable to hedge NOK receivables using FX knock-in forwards.

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says