As we do not expect the USDJPY to exceed 126 (multiyear tops) in H1'2016 as more headwinds are surrounding Yen, especially owing to the strong US growth that likely to lead an aggressive Fed hikes and a spike in UST yields, resulting in broad USD strength, and the BoJ accelerates debt monetization and Japan’s inflation expectations materially rise.

We prefer for a call spread ratio 1x1.5 instead of vanilla structures, such that the topside breakeven is at this level. Shorting volatility means negative convexity, and investors would thus suffer in terms of mark-to-market if USDJPY gains were to accelerate early.

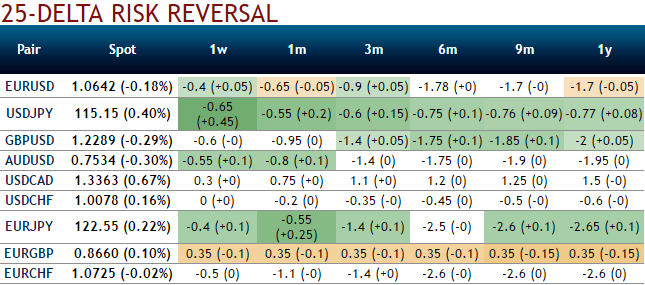

Please be noted that the positive hedging bids for USDJPY in 1w risk reversals and IV skews are evidencing mounting hedging interests for upside risks (while articulating) ahead of BoJ event. Hence, even the underlying pair keeps dragging it upto above-stated levels within a span of 3m tenors.

As a result, on hedging grounds, we advocate buying USDJPY 6m call spread strikes of 112.5/125 (at spot ref: 113.609).

As you could make out you keep earning from these positions as long as the underlying spot Fx of USDJPY keeps spiking above 115.882 on expirations (BEP in six months). USDJPY acceleration beyond 118 after the first two months would hurt the mark-to-market of the strategy.

We mitigate that risk by selecting a 6m expiry, which reduces the negative gamma compared to a shorter expiry and fits the idea of a gradual appreciation.

However, lengthening the maturity would not by itself fully prevent the risks inherent to a short gamma profile. So we pick sufficiently OTM strikes to protect the trade against a two-month move to 112.50 and a six-month to 125.

All in all, the trade is profitable if the USDJPY trades between 115.882 and 125 in six months and likely to generate a maximal leverage at the 124.966 strike. This breakeven level increase if the implied volatility falls.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise