DXY (dollar index) which measures the greenback’s strength against a trade-weighted basket of six major currencies, was currently up at 94.90 comparing previous close at 94.65.

Overnight, the dollar trimmed losses against the other major currencies on Thursday, as markets digested remarks made by ECB president Mario Draghi and a mixed bag of U.S. economic reports.

The ECB's stance could prompt the Federal Reserve to follow suit when it faces a similar interest rate decision next week.

On the flip side, the recent USD weakening illustrates how fast significant exchange rate movements can occur – especially when a currency is trading far from its long-term fair value.

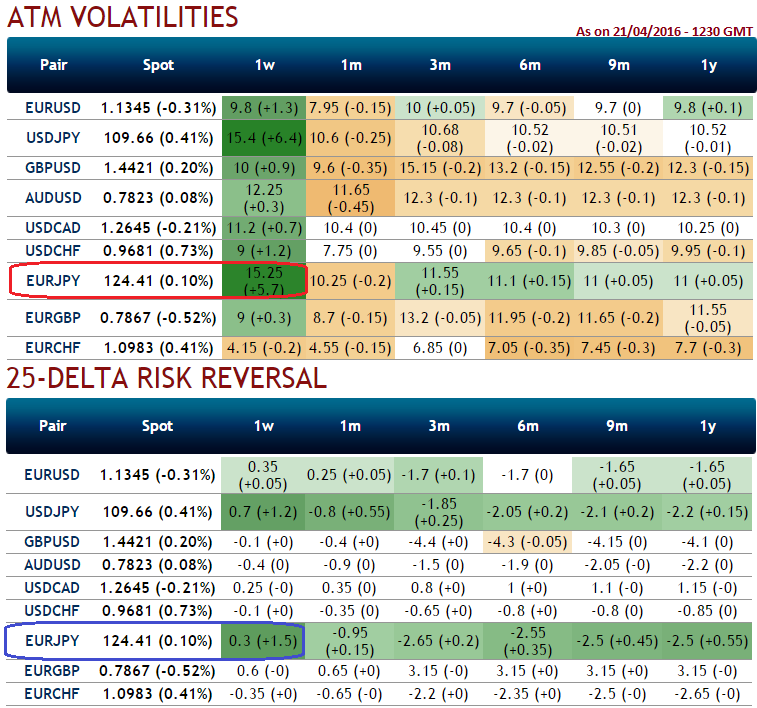

At spot FX flashes of EURUSD at 1.1257 we see delta risk reversal for contracts of 1W and 1M expiries have shown bullish recovery signals, but in long term (3M-1Y, i.e. H2’ 2016) put contracts are on higher demand.

But the participants seems to have shrugged off the bullish hedging sentiments in EURUSD OTC FX markets as you can make out from the nutshell showing EURUSD’s implied volatilities of 1M at the money contracts are shrinking away, the least among G7 currency space, shy below 8% (precisely at 7.95%).

As such, we recommend taking advantage of the slowdown in the USD depreciation and the expected short-term USD strengthening to lock in USD-denominated income receivable on a long-term horizon via FX forwards.

Alternatively, investors could consider taking advantage of any short-term fall in EUR/USD by hedging USD-denominated income receivable over the next six months via boosted risk reversals.

This strategy would maintain a profit in the event of a fall in EUR/USD, while also securing a historically attractive buying rate. We emphasize that the strategy would not guarantee a worst-case exchange rate in the event of a sharp EUR/USD fall, as the trade obliges the purchase of a double EUR/USD notional.

Specifically, a 6M strategy with six monthly payments could be entered at zero cost (spot ref. 1.1350). The chart on the right illustrates that, on each of the six settlement dates, the trade gives the right to buy EUR/USD at 1.1550 if the spot rate is trading above 1.1550 on a settlement date.

If the spot rate is trading below 1.0900 on a settlement date, there would be an obligation to buy the double notional at 1.0900.

As such, a worst-case exchange rate for any large falls in EUR/USD would not be guaranteed. Nonetheless, we consider the strategy an attractive alternative, as the spot rate would have to trade below around 1.0500 on a given settlement date to result in a less attractive effective buying rate relative to hedging via FX forwards.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks