The BoJ’s negative rate policy was the right decision, as without the move JPY could be much stronger. Ms Masai, as a new BOJ board member comments on strong concerns over the recent JPY appreciation and its impact on the economy. We think she is likely to vote for easing, when Governor Kuroda proposes easing going forward.

The BOJ is very likely to downgrade its inflation forecast next week and the likelihood of a BOJ easing remains high. Expectations of a BOJ easing will support GBP/JPY into the meeting next week, in our view.

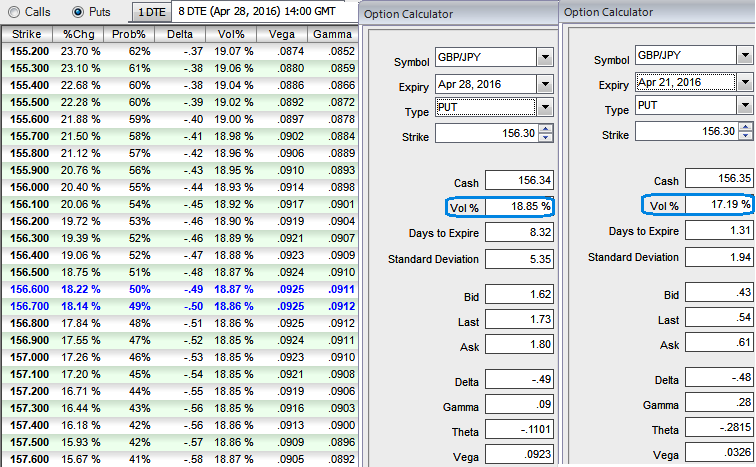

Please have a glance on how implied volatilities of ATM puts of 1D and 1W expiries are acting crazily in OTC markets, 17.19% and 18.85% respectively ahead of data releases such as UK’s claimant count change, unemployment rate change are scheduled to be announced today, retail sales and manufacturing PMI in Japan for tomorrow.

These short term volatilities are majorly owing to BoE's governor speech. Officials are expected to stand pat on the benchmark interest rate a record low 0.5% in coming months as well on the fears of Brexit pressures.

Subsequently, what is weighing on the pound's slumps is that, the expectations on BoE’s unlikely changes, above all lingering Brexit probabilities add an extra pressure on sterling's depreciation.

Technically, the recent bounces above 7DMA have now faced a stiff resistances at 157.178 (21DMA) and near upper trend line.

Daily price slid below trend-line and 21DMA and the buying momentum is suspected from here onwards as RSI & Stochastic oscillators on intraday charts (4H) have approached overbought trajectory and signaling selling pressures.

Hence, we advocate the suitable strategy to hedge these downside risks by using these small bounces from then to help our ITM shorts, this would have certainly ensured returns in the form of premiums.

So, stay firm with longs on 2 lots of 1M At-The-Money Vega puts that would function effectively in progressively higher IV times (see sensitivity table for higher probabilities and stabilized Vega growth). Simultaneously, deploy shorts side of 1 lot of 3D (0.5%) ITM put option.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady