Japan's lackluster preliminary GDP figures give us the hints on contraction in economic growth. Last week's reducing unemployment in U.K. leads more consumer buying sentiments which in turn signs on GBPs strength.

More GBP buying today cannot be ruled out if we get a further rise in average earnings for the three-month period, while unchanged CPI and reducing retail sales expectation stresses GBP.

But for foreign traders are advised to safeguard their FX exposures through suitable hedging arrangements as mixed bag of economic numbers may damage British currency in short run, as a result we came up with below strategy on hedging grounds.

We feel GBP is in good shape but is it good enough to keep our currency exposures in naked positions and confront Yen's uncertainty; this has certainly been a tough call.

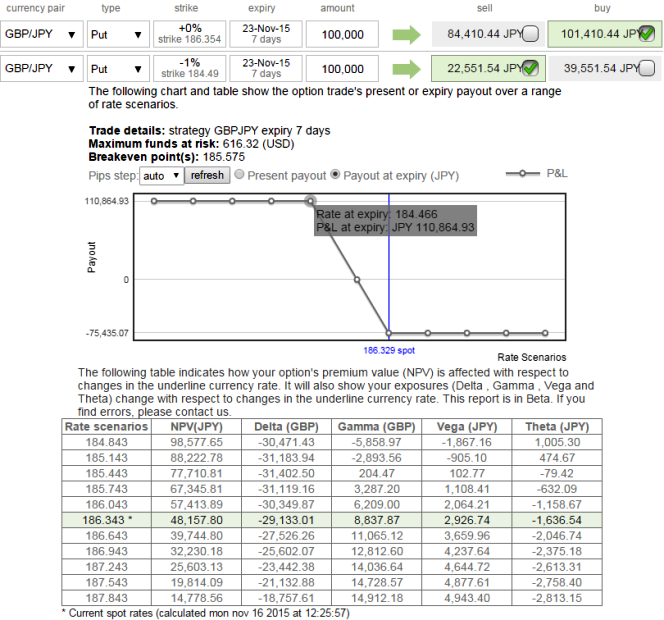

Therefore, bear put spread shall be used over Protective Put as the premiums on naked puts prove too costlier.

Bear Put Spread = Long ATM -0.5 delta Put (186.545) + Sell another -1% OTM Put with lower Strike Price (Out of the Money = 184.49) with net delta should be at around -0.30.

For a net debit bear put spread reduces the cost of hedge by the premium collected (¥22551.54 on the shorts of OTM put) and keeps hedger to participate on upward moves but it comes at the expense of Partial hedge rather than a complete hedge.

For demonstration purpose only, we've used identical maturities, in live scenarios prefer shorter maturities on short side.

FxWirePro: Hedge GBP/JPY downside risks via debit put spread

Monday, November 16, 2015 7:05 AM UTC

Editor's Picks

- Market Data

Most Popular