It’s been central banks’ monetary policy season in G10 economies, SNB, BoE, FED, and BoJ are lined up for monetary policy meetings in this month, followed by RBA on October 1st week.

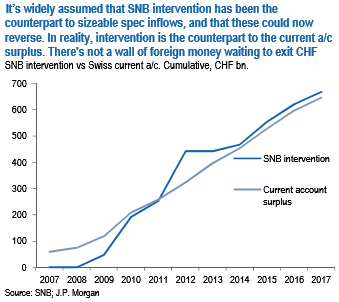

As a matter of balance of payments arithmetic, SNB intervention has been the counterpart to Switzerland’s current account surplus over the past decade, not speculative inflows.

Indeed, the SNB’s cumulative intervention since 2007 is almost exactly the same as the cumulative current account surplus over this period (around CHF 650bn – refer above chart).

The driving force for CHF appreciation over this period is therefore not speculative capital inflows, but rather a persistent dearth of capital outflows. That may seem like a semantic difference but is, in fact, crucial to how we assess the franc’s prospects. If our analysis is correct, there simply is no wall of safe-haven money that should flood out of CHF, irrespective of how bright the euro’s prospects.

On the flip side, AUD likely to gain more traction given the RBA adopts a more hawkish tone to its communications during its cash rate announcement that's scheduled on October 3rd.

Our RBA outlook (on hold for some time) is anchoring short-maturity interest rates, if the Aussie central bank maintains firmly on hold stance in its next monetary policy, as we expect, the counterpart currency would likely gain upper hand, which in turn lead the underlying pair (AUDCHF) non-directional trend that has prolonged in long run.

For more reading on our technicals analysis, refer below weblink:

But what is more significant for AUD is that Chinese data has been volatile in recent months, but Aussie dollar appears to be largely fair given the twists and turns in Chinese financial conditions of late.

AUD has traced China’s on-again off-again policy shifts on financial conditions and liquidity reasonably well over the past 9 years (refer above chart).

These mini-turns in financial conditions have not been easy to predict ahead of time, the cycle length is shortening, and the transmission to commodities looks more speculative than fundamental.

Still, these cycles have been influential for AUD, and suggest that any further developments by Chinese authorities on this front will bear watching in coming months.

Options strategy:

We recommend positioning longs in AUDCHF via optionality ahead of above-stated data events.

Long ADUCHF portfolios that make us shorting CHF vols all the more appealing. Instead of naked vanilla call form, we suggest call spread structure for the 1M horizon, optimizing strikes for leverage.

The strategy reads this way, longs in 1m ATM +0.51 delta call, simultaneously, short 2w (1%) OTM call at net debit.

Courtesy: JP Morgan

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025