Gold price is suffering its worst week in more than three years, and Gold CFDs lost over -3.69% or $56 an ounce, currently trading $1,458.60 levels.

Looking into next year though, a Fed on hold would add significant downside risk to our bullish outlook on gold prices assuming that the US macro environment remains consistent with a mid-cycle adjustment (resilience in employments and consumer spending, rebound in manufacturing). As we can see from last week's price resilience and the market’s continued insistence to price in further 2020 easing for now, this assumption on the macro front looks far from assured for many market participants, including us.

While conflicting comments by high-level officials have raised questions as to whether the US and China will agree to lift existing tariffs gradually.

The safe-haven or investor demand for gold has been considerably mounting during 2019, the appetite for the precious yellow metal is growing as the amount of gold held by gold-backed ETFs hit a record high in the recent times.

Gold’s (XAUUSD) price has reclaimed $1,500 mark as the major uptrend resumed but the rallies appear to have been exhausted at the stiff resistance of 1518 levels as it continued the range bounded swings in the minor trend. It has surged almost more 17% so far in this year.

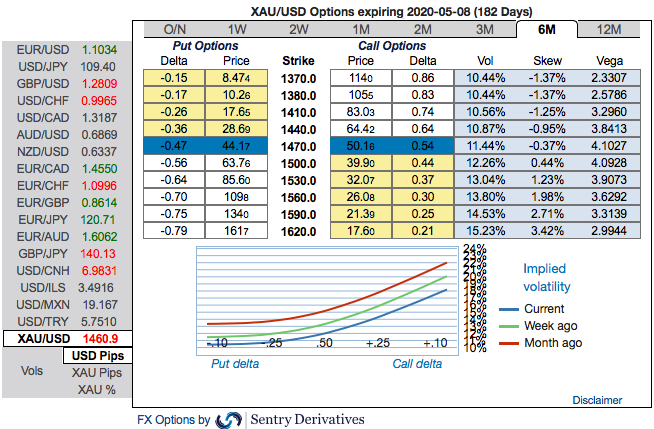

Simultaneously, the 6m positive skewness of options contracts of gold implies more demand for calls than puts (refer 1st chart). These skewed IVs of 3m XAUUSD contracts are still indicating the upside risks. One could also see bullish risk reversal setup. To substantiate the above-mentioned dubious bullish sentiment, risk reversal (RRs) numbers indicate overall bullish environment amid minor negative hedging sentiments (2nd nutshell).

The above risk reversal numbers have been known as a gauge of gold’s underlying market for bullish opportunities. Well, we know that options are predominantly meant for hedging a probable risk event in future.

Trading and Hedging Strategy:

We rightly predicted the abrupt dips in the gold price in the short-run, capitalizing on that and OTC indications, bullish neutral risk reversals of gold, we advocated longs in gold via ITM call options as they look to be the best suitable at this juncture.

Thus, we still advocate buying 3m XAUUSD (1%) ITM -0.69 delta calls on hedging grounds. If expiry is not near, delta movement wouldn’t be 1-point increase with 1 pip in the underlying movement, which means if the spot moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money call option with a very strong delta will move in tandem with the underlying. Courtesy: Sentrix and Saxobank

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential