- Gold edged lower almost $10 from the high of $1296.20 and it is currently trading around $1285.

- Market braces for key events today for further direction. Major events for the day UK election, ECB decision and Former FBI director Corney testimony before senate.

- EURO declined yesterday as ECB said to downgrade inflation forecasts tomorrow meeting. ECB is expected to keep its interest rates unchanged at 0% and deposits rate at -0.4%.

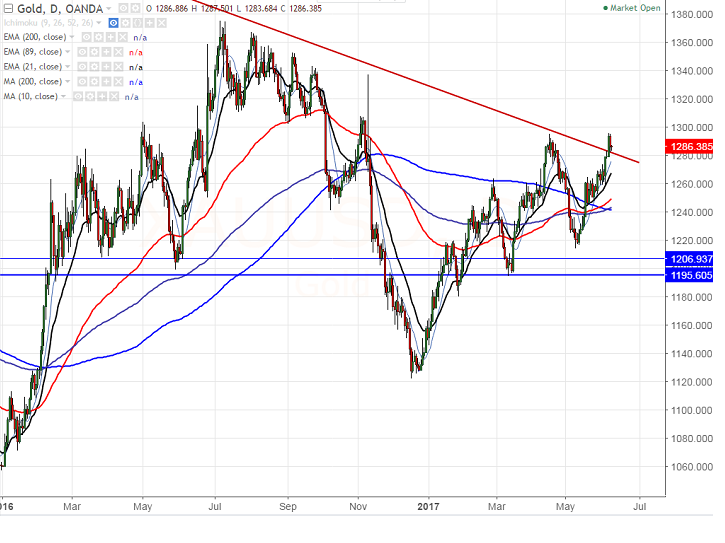

- In the daily chart, gold’s near term support is around $1272 (10 – day MA and 200 –H MA) and break below will drag the commodity down till $1264 (21- EMA)/$1259.

- On the higher side, any close above $1295 (Apr 17th 2017) will take the commodity to next level till $1337/$1352.

It is good to buy on dips around $1273 with SL around $1264 for the TP of $1295/$1337.