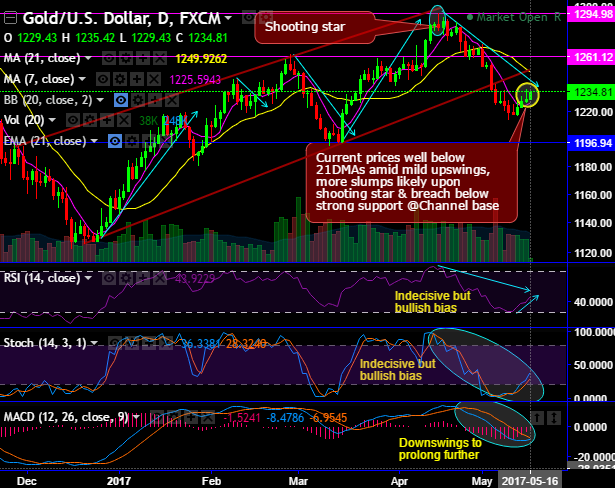

Bullion prices have gained during Asian trading session from the yesterday’s close at $1,229.43, but the current prices still well below 21DMAs amid these mild upswings.

Prior to this, the gold price behavior was moving in rising channel but failure swings have also been observed as and when it nears channel resistance (refer daily charts), and more slumps are foreseen in the weeks to come upon shooting star & the breach below strong support at channel base.

Historically, shooting star also pops up at this same resistance levels and evidently rest is the history, in an interim uptrend, gold prices have almost retraced to the lows of 1259 from the recent highs of 1295 levels in the consolidation phase.

RSI and stochastic curves are converging to the price drop to indicate the strong selling momentum on monthly but slightly indecisive to bullish biased on daily terms.

While MACD on the other hand signals downswings is expected to extend.

On a broader perspective, bulls in this bullion market have managed to bounce above 50% Fibonacci retracements but restrained below 61.8% levels. And the current prices on this timeframe are hovering at around 50% fibos and 21 EMA levels amid mild upswings.

MACD is also signaling the slumps to prolong further. Overall, contemplating all these technical rationales we see major trend has still been weaker ahead of Fed’s rate speculation.

For an intraday speculation, we see the price to remain within the range between 1240 and 1229, we advocate buying boundary binaries with upper strikes at 1240 and lower strikes at 1229 levels.

The trading between these strikes likely to derive certain yields in this puzzling trend and more importantly these yields are exponential from spot movements.

For cash or nothing, these options would be exercised if the forward prices to remain between both strikes (i.e. 1229 > Fwd price > 1240).