Gold firmed on Friday as forecast-beating euro zone inflation boosted the euro against the dollar, while global stock markets retreated from Wednesday's record highs as concerns about global trade subdued appetite for cyclical assets.

We reckon the below OTC indications and trend in bullion markets seem to be reasonably addressed by hedging participants, hence, we advocate below option strategy to mitigate uncertainty hover in spot gold prices, the strategy likely to keep underlying price risk in check regardless of price swings with cost effectiveness.

Spot gold was up 0.2 pct at $1,266.11 an ounce at 0945 GMT, while on the Comex division of the NYME, gold futures for mid-month delivery (June) were little changed at $1,266.36.

Hedging Framework:

Strategy: 2m 3-Way Diagonal Straddle versus OTM Put

Spread ratio: (Long 1: Long 1: Short 1)

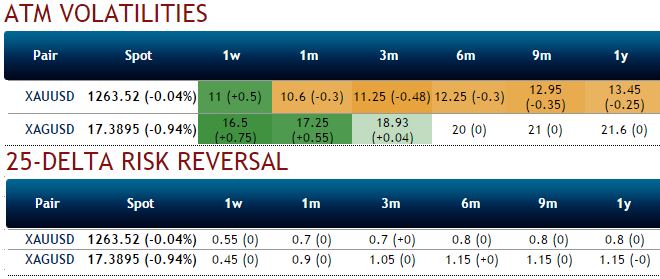

Rationale: Let’s glance on sensitivity tool, the bullish neutral risks reversals indicate upside risks in underlying spot gold prices, while shrinking implied volatilities signify the put writers’ advantages.

Please also be noted that the 1W ATM puts are exorbitantly priced above 57% more than NPV, while 1w IVs just shy above 11%, this disparity should optimally be utilized in below option strategy.

For 2m IV skews would signify the interests of OTM call strikes that mean the ATM calls higher likelihood of expiring in-the-money, so writing overpriced OTM puts would be a smart move to reduce hedging cost.

The execution:

Go long in XAUUSD 1M at the money -0.49 delta put, and go long 2M at the money +0.51 delta call and simultaneously, Short 2W (1%) out of the money put. Thereby, we favor bulls as we foresee more upside risks by keeping longer tenors on call leg.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty